Fundamentals

You feel the subtle shifts within your own body, the persistent fatigue, the mental fog, or the slow decline in vitality that labs might not fully capture. You hear about promising peptide therapies, molecules that work with your body’s own signaling systems, and you wonder why these elegant solutions seem so distant, so complex to bring into your personal wellness protocol.

The path from a brilliant discovery in a lab to a vial in a clinician’s office is a journey measured in years and hundreds of millions of dollars. This journey is governed by a process designed with a singular, deeply personal purpose ∞ to protect you.

The economic architecture of regulatory approval is built upon the foundational need to ensure that any therapeutic agent introduced into the human system is both safe and effective. Every dollar spent, every procedural step, is a proxy for a scientific question that must be answered with overwhelming certainty before it can be offered as a solution.

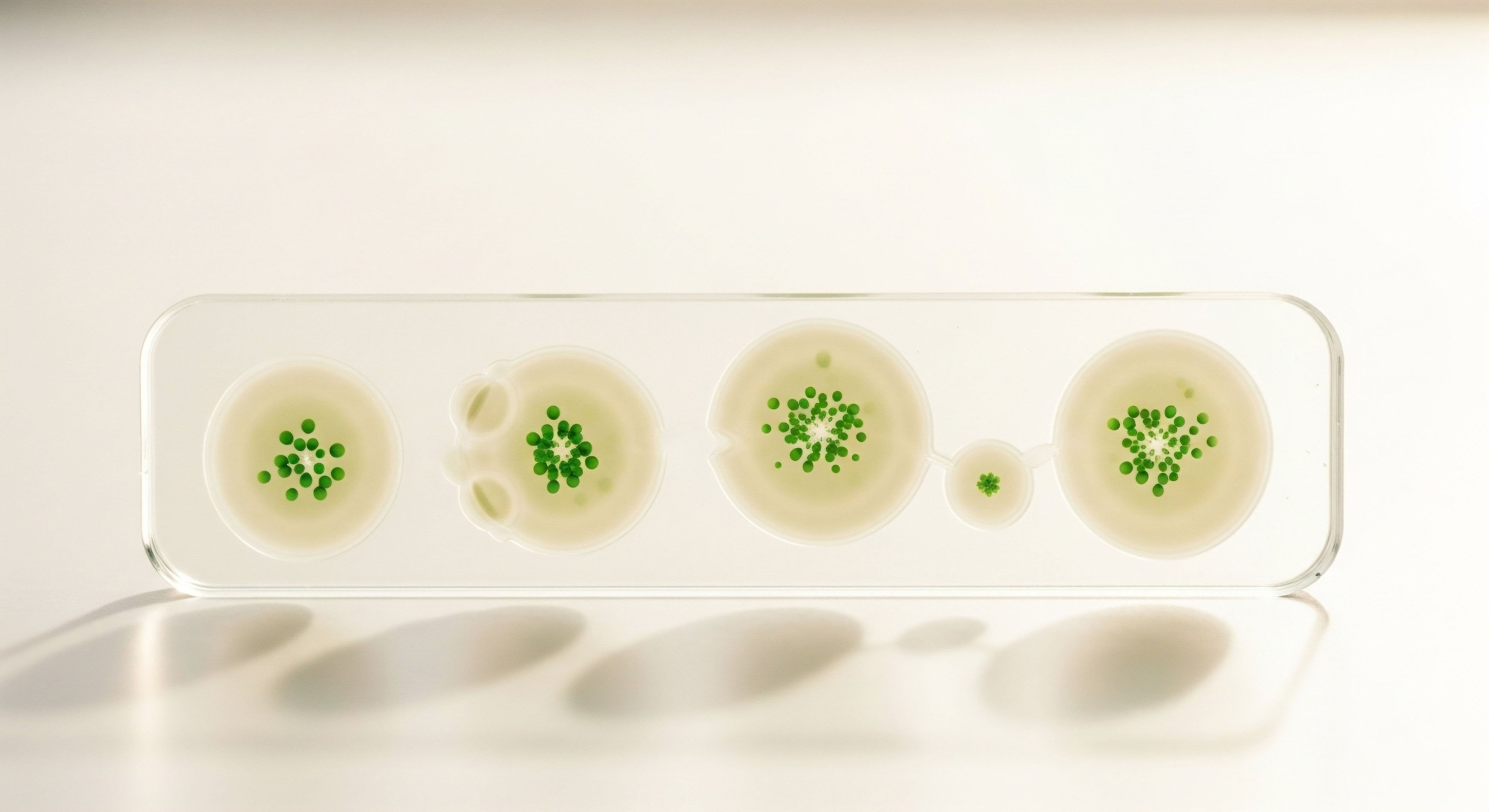

The journey begins long before a single human participant is involved. This initial stage, the preclinical phase, is where the foundational science happens. Researchers investigate the peptide’s mechanism of action ∞ how it interacts with cells, its stability, and its potential for toxicity. This involves extensive laboratory work and animal studies.

These early steps are economically intensive. The synthesis of a high-purity peptide for research is a specialized process. The subsequent biological and toxicological assessments require sophisticated equipment and highly trained personnel. The financial investment here is speculative; the vast majority of compounds explored at this stage will never proceed to human trials.

The economic gamble is substantial, yet this foundational work is the bedrock upon which all future clinical confidence is built. It is the system’s first and most critical filter, designed to eliminate compounds that are overtly dangerous or biologically inert, saving immense future cost and, more importantly, preventing potential harm.

The entire regulatory framework is an economic and scientific system designed to convert uncertainty into predictable safety and efficacy.

Once a peptide demonstrates a promising safety and activity profile in preclinical studies, the sponsoring company files an Investigational New Drug (IND) application with a regulatory body like the U.S. Food and Drug Administration (FDA). This document is a comprehensive dossier of all the preclinical data, manufacturing information, and the proposed plan for human trials.

The cost to compile this application is significant, involving regulatory experts, scientists, and attorneys. Its approval marks a pivotal economic milestone ∞ the transition from laboratory concept to clinical reality. This is the gateway to Phase 1 clinical trials, the first time the peptide will be introduced to the human body.

Phase 1 trials are primarily focused on safety. A small group of healthy volunteers receives the peptide to determine the safe dosage range and identify any immediate adverse effects. The economic inputs here include compensating participants, intensive monitoring by clinical staff, and detailed pharmacokinetic analyses to understand how the body processes the substance. While scientifically focused on safety, the economic output is a critical piece of data that informs whether the far greater investment in subsequent phases is justifiable.

Following a successful Phase 1, the journey moves to Phase 2 clinical trials. Here, the focus expands to include efficacy. The peptide is administered to a larger group of individuals who have the condition the therapy is intended to treat. This phase aims to answer two questions ∞ Does the peptide work for its intended purpose, and what is the optimal dose?

The economic costs escalate significantly in Phase 2. Recruiting patients with specific health conditions is more complex and expensive than recruiting healthy volunteers. The trials are longer, and the monitoring is more detailed, often involving specialized imaging or biomarker tests to measure the therapeutic effect. This phase represents a major financial inflection point.

The data gathered here provides the first real signal of the peptide’s potential commercial viability. A strong positive signal will attract further investment for the final, most expensive stage, while ambiguous or negative results often lead to the termination of the project, representing a substantial financial loss.

The culmination of the clinical development process is the Phase 3 trial. This is the largest, longest, and most expensive part of the regulatory journey. These trials can involve hundreds or even thousands of participants across multiple clinical sites, sometimes in different countries.

The goal is to confirm the peptide’s effectiveness in a large, diverse population, continue to monitor for safety and side effects, and compare its performance against existing treatments or a placebo. The economic scale of Phase 3 is immense.

Costs include managing numerous research sites, paying for the medication for all participants, extensive data collection and analysis by biostatisticians, and ensuring compliance with stringent regulatory standards across the entire study. A single Phase 3 trial for a biologic or peptide can cost tens to hundreds of millions of dollars.

This massive expenditure is the final validation, the definitive evidence required by regulators to determine if the benefits of the new therapy outweigh its risks. It is the price of certainty on a population-wide scale, and it is the largest single economic factor influencing the final cost of the therapy should it gain approval.

Intermediate

Understanding the economic landscape of peptide therapy approval requires a deeper look into the specific cost drivers that define the process. These are the granular financial inputs that accumulate to create the formidable barrier to market entry.

Two primary domains contribute the bulk of the expense ∞ the manufacturing process, known as Chemistry, Manufacturing, and Controls (CMC), and the execution of the clinical trial program itself. Each presents a unique set of economic challenges that must be overcome to bring a therapeutic peptide from concept to clinical application.

The Economics of Peptide Synthesis and Manufacturing

The cost of producing a peptide is fundamentally different from that of a conventional small-molecule drug. Peptides are larger, more complex molecules, and their synthesis requires a specialized, multi-step process. The dominant method for producing therapeutic peptides is Solid-Phase Peptide Synthesis (SPPS), a technique that builds the amino acid chain one residue at a time.

The raw materials for this process, specifically the highly purified and protected amino acids, are expensive. The complexity of the synthesis also means that yields can be low, and the purification process required to achieve the greater than 98% purity demanded by regulatory agencies is technologically intensive and costly.

High-performance liquid chromatography (HPLC) is often used for this purification, a method that is difficult and expensive to scale up for commercial production. These technical challenges create a high cost of goods sold (COGS) for the active pharmaceutical ingredient (API), the peptide itself.

Furthermore, regulatory bodies demand stringent adherence to Good Manufacturing Practices (GMP). Establishing a GMP-compliant manufacturing facility requires a massive capital investment in specialized equipment, cleanroom environments, and quality control laboratories. The ongoing costs of maintaining GMP standards, including rigorous testing of every batch, detailed documentation, and highly trained personnel, add a significant operational expense.

Many biotechnology companies do not have the capital or expertise to build their own manufacturing facilities. They rely on a small number of specialized Contract Manufacturing Organizations (CMOs) that have this capability. This creates a bottleneck in the supply chain and gives these CMOs significant pricing power, further contributing to the high cost of peptide manufacturing.

The economic reality is that the physical production of the peptide represents a substantial portion of the overall development cost, a factor that is much less pronounced in traditional small-molecule drug development.

What Are The Primary Cost Centers In Clinical Trials?

Clinical trials are the most significant economic component of the drug development process. A 2020 study published in JAMA Internal Medicine found that the median cost of a Phase 3 trial for a biosimilar, a category similar in complexity to many peptides, was approximately $27.6 million, with some trials costing substantially more. These costs are driven by a variety of factors that extend far beyond the cost of the drug itself.

- Patient Recruitment and Retention ∞ Finding and enrolling qualified patients for a clinical trial is a major undertaking. It often involves advertising, screening thousands of potential candidates, and working with multiple clinical sites. Once enrolled, patients must be retained for the duration of the study, which can last for years. This may involve compensating them for their time and travel, creating a significant line item in the trial budget.

- Clinical Site Management ∞ Phase 3 trials are typically conducted at dozens or even hundreds of hospitals and clinics around the world. Each of these sites must be managed, and the clinical staff must be trained on the specific protocols of the study. The costs include payments to the principal investigators (physicians), clinical research coordinators, and the institutions themselves for their overhead.

- Data Collection and Analysis ∞ Modern clinical trials generate a tremendous amount of data. Every test, observation, and patient-reported outcome must be meticulously recorded, entered into a secure database, and verified for accuracy. This process, known as data management, is labor-intensive. Subsequently, biostatisticians must analyze this data to determine the statistical significance of the findings, a highly specialized and critical function.

- Regulatory and Administrative Costs ∞ Throughout the trial, there is a constant need for interaction with regulatory agencies. This includes submitting safety reports, amending study protocols, and ultimately, compiling the massive New Drug Application (NDA) for final review. This requires a team of regulatory affairs specialists and can involve significant legal and consulting fees.

| Phase | Primary Goal | Typical Number of Participants | Median Duration | Estimated Median Cost |

|---|---|---|---|---|

| Phase 1 | Safety and Dosage | 20-100 Healthy Volunteers | Several Months | $5 – $10 Million |

| Phase 2 | Efficacy and Side Effects | 100-500 Patients | Several Months to 2 Years | $15 – $30 Million |

| Phase 3 | Confirm Efficacy, Long-term Safety | 300-3,000+ Patients | 1 to 4 Years | $25 – $100+ Million |

Pharmacoeconomics the Gatekeeper to Market Access

Gaining regulatory approval is only one part of the battle. The second, equally important economic hurdle is securing reimbursement from government payers and private insurance companies. These organizations are the ultimate purchasers of the therapy, and they make decisions based on a field of study called pharmacoeconomics.

This discipline evaluates the economic value of a new drug in relation to its cost. The central question is whether the new therapy provides enough clinical benefit to justify its price tag, especially when compared to existing treatments.

A peptide therapy’s journey from lab to clinic is ultimately determined by a complex economic equation balancing immense R&D costs against the demonstrable value it provides to both patients and the healthcare system.

To make these determinations, payers use tools like cost-effectiveness analysis (CEA). A CEA calculates a metric known as the Incremental Cost-Effectiveness Ratio (ICER). The ICER represents the additional cost required to gain one additional unit of health benefit. That health benefit is often measured in Quality-Adjusted Life Years (QALYs).

A QALY is a sophisticated metric that combines both the quantity (length) and quality of life. For example, a year lived in perfect health is equal to 1 QALY, while a year lived with a debilitating condition might be valued at 0.5 QALYs. A new therapy that extends life by two years at a quality level of 0.7 would provide 1.4 QALYs.

The ICER is calculated as (Cost of New Therapy – Cost of Old Therapy) / (QALYs from New Therapy – QALYs from Old Therapy). Payers, such as the UK’s National Institute for Health and Care Excellence (NICE), have an implicit or explicit threshold for what they are willing to pay per QALY.

In the UK, this is typically in the range of £20,000-£30,000 per QALY. If a new peptide therapy has an ICER above this threshold, it may not be considered “cost-effective” and will not be reimbursed, effectively blocking its access to patients within that healthcare system.

This economic reality forces drug developers to generate clinical trial data that demonstrates not only safety and efficacy, but also a significant improvement in quality of life or a reduction in other healthcare costs (like hospitalizations) to justify a high price. The need to prove pharmacoeconomic value adds another layer of complexity and expense to the development process, directly influencing which therapies are pursued and how they are ultimately priced.

Academic

The economic architecture supporting the regulatory approval of peptide therapies is a highly complex system governed by the interplay of intellectual property law, market exclusivity incentives, and sophisticated pharmacoeconomic modeling. These forces dictate the flow of capital, shaping the strategic decisions of pharmaceutical companies and ultimately determining which therapeutic innovations reach the clinical setting.

An academic analysis reveals that the entire business model for therapeutic development rests on a calculated trade-off ∞ a time-limited monopoly, secured through patents and regulatory exclusivities, in exchange for the immense upfront financial risk required to navigate the development and approval gauntlet.

Intellectual Property as the Foundational Economic Driver

The primary economic engine for peptide therapeutic development is the patent system. A patent grants the inventor exclusive rights to their invention for a limited period, typically 20 years from the filing date. For a peptide therapy, this protection is multifaceted and strategically layered to create a durable competitive advantage.

The most valuable patent is the “composition of matter” patent, which covers the novel peptide sequence itself. This provides the broadest protection, preventing any other company from making, using, or selling that specific molecule.

Given that many therapeutic peptides are analogues of naturally occurring human hormones or signaling molecules, proving the “novelty” and “non-obviousness” required for a composition of matter patent can be challenging. Therefore, companies pursue a portfolio of patents to build a protective fortress around their asset. This includes:

- Method-of-Use Patents ∞ These patents cover the use of a specific peptide to treat a particular disease or condition. Even if the peptide itself is known, a new therapeutic application can be patented.

- Formulation Patents ∞ Peptides are often unstable and require sophisticated formulations to ensure their stability and control their release profile. These formulations, which can include specific excipients, stabilizers, or delivery technologies like encapsulation, can be patented independently.

- Manufacturing Process Patents ∞ The specific chemical synthesis or recombinant manufacturing process developed for a peptide can also be a source of intellectual property. A novel, more efficient synthesis method can be patented, creating a barrier for potential competitors who would need to develop their own, non-infringing process.

This “patent estate” is the primary asset that justifies the hundreds of millions of dollars in R&D investment. The period of market exclusivity granted by these patents is the only time the company can recoup its investment and generate a profit before generic or biosimilar competition emerges.

The economic calculation is straightforward ∞ the potential revenue generated during the patent-protected period must exceed the total risk-adjusted cost of development. This reality heavily influences which research programs are funded. Peptides targeting conditions with large patient populations and significant unmet medical need are more likely to attract investment because the potential return on investment is higher.

How Does Market Exclusivity Extend Beyond Patents?

Beyond the standard patent term, regulatory agencies provide additional forms of market exclusivity to incentivize development in specific areas. These exclusivities are granted upon approval and run concurrently with patents, but can provide protection even if the primary patent has expired or is challenged. One of the most significant is Orphan Drug Exclusivity (ODE).

In the United States, a therapy that treats a disease affecting fewer than 200,000 people can be granted orphan drug status. Upon approval, this provides seven years of market exclusivity, during which the FDA will not approve another application for the same drug for the same indication. This is a powerful economic incentive to develop therapies for rare diseases, a market that might otherwise be considered too small to generate a sufficient return on investment.

Another critical exclusivity is related to biologics. In the U.S. a new biologic product, which includes many larger peptides produced through recombinant DNA technology, receives 12 years of data exclusivity from the date of approval. This prevents a biosimilar competitor from relying on the innovator’s clinical trial data to gain approval for that 12-year period.

These exclusivity periods are a direct legislative tool to adjust the economic risk-reward calculation for drug developers. They provide a predictable period of monopoly revenue that is essential for securing the initial and ongoing funding required for development.

| Exclusivity Type | Governing Body Example (U.S.) | Duration | Economic Rationale and Impact |

|---|---|---|---|

| Patent Term | USPTO | 20 years from filing | Provides the foundational period to recoup R&D costs. The effective commercial life is often much shorter due to the long development and approval timeline. |

| Orphan Drug Exclusivity (ODE) | FDA | 7 years from approval | Incentivizes development for rare diseases by providing a guaranteed monopoly in a small market, making commercially non-viable projects attractive. |

| New Chemical Entity (NCE) Exclusivity | FDA | 5 years from approval | Provides a baseline period of data exclusivity for new small-molecule drugs, preventing generic applications that rely on the innovator’s data. |

| Biologics Data Exclusivity | FDA | 12 years from approval | A powerful incentive for biologic development, providing a lengthy period of protection from biosimilar competition and securing a long revenue stream. |

The Role of Pharmacoeconomics in Late-Stage Development and Pricing

The final economic gatekeeper is the pharmacoeconomic assessment performed by payers. The high price of a new peptide therapy is a direct consequence of the immense cost and risk of its development, filtered through the need to generate a return on investment during its limited period of market exclusivity.

However, this price must be justified to payers who control market access. The entire design of late-stage clinical trials is now heavily influenced by the need to collect data that will support a favorable pharmacoeconomic evaluation.

This means Phase 3 trials are designed to measure endpoints that are meaningful to payers, such as improvements in quality of life (for QALY calculations), reductions in hospitalizations, or the ability for patients to return to work. These data are then used to build complex economic models that project the long-term value of the therapy to the healthcare system.

The negotiation between a pharmaceutical company and a national payer is a negotiation over this perceived value. The company will argue that the high price is justified by the R&D investment and the long-term clinical and economic benefits the therapy provides. The payer will scrutinize this data, seeking to minimize its budget impact.

The price of a novel peptide therapy is a complex synthesis of development costs, intellectual property value, and the quantified clinical benefit it delivers to patients.

This dynamic creates a significant ethical and economic tension. The system is designed to reward innovation with high prices, which in turn funds future research. However, these same high prices can create access barriers for the very patients the therapies are designed to help.

The economic considerations of regulatory approval are therefore inseparable from the broader societal debate about sustainable healthcare spending and equitable access to medical innovation. The approval of a peptide therapy is not an endpoint; it is the beginning of a complex economic lifecycle that balances the recovery of private investment against the public good of accessible healthcare.

References

- Srivastava, V. “Chapter 1 ∞ Regulatory Considerations for Peptide Therapeutics.” Peptide Therapeutics ∞ Strategy and Tactics for Chemistry, Manufacturing, and Controls, edited by Ved Srivastava, Royal Society of Chemistry, 2019, pp. 1-30.

- Lax, E. R. and T. Shah, editors. “Economic and environmental factors affecting the sustainability of peptide therapeutic manufacturing.” Polypeptide, Royal Society of Chemistry, 2019.

- Moore, T. J. et al. “Assessment of Availability, Clinical Testing, and US Food and Drug Administration Review of Biosimilar Biologic Products.” JAMA Internal Medicine, vol. 181, no. 1, 2021, pp. 52-60.

- “Ethical and Regulatory Considerations in Peptide Drug Development.” Journal of Chemical and Pharmaceutical Research, vol. 16, no. 5, 2024, pp. 7-8.

- DiMasi, J. A. et al. “Innovation in the pharmaceutical industry ∞ New estimates of R&D costs.” Journal of Health Economics, vol. 47, 2016, pp. 20-33.

- “Biopharmaceuticals ∞ The Patent Implications of Peptide Therapeutics.” PatentPC, 8 July 2025.

- Neumann, P. J. et al. “Cost-Effectiveness in Health and Medicine.” 2nd ed. Oxford University Press, 2016.

- “The benefits and pitfalls of drug manufacturing IP (T 2543/22).” OPUS IP, 22 February 2025.

- Gottlieb, S. “FDA’s new policy steps to promote the development of novel treatments for rare diseases.” FDA, 2017.

- Drummond, M. F. et al. “Methods for the Economic Evaluation of Health Care Programmes.” 4th ed. Oxford University Press, 2015.

Reflection

You have now seen the intricate economic machinery that operates behind the curtain of therapeutic development. The path from a promising molecule to a protocol that can recalibrate your own physiology is paved with immense financial risk, strategic intellectual property decisions, and rigorous scientific validation. This knowledge transforms your perspective.

The cost and time associated with a new peptide therapy are a direct reflection of the collective effort to ensure it is a reliable and safe tool for your health. This understanding is the first step. The next is to consider how this information applies to your own journey.

How does knowing the value proposition behind a therapy change the conversation you have with your clinician? Recognizing the immense system of validation behind each approved protocol empowers you to ask more precise questions and become a more active participant in the decisions that shape your health and vitality for years to come.

Glossary

regulatory approval

food and drug administration

clinical trials

peptide therapy

clinical trial

biosimilar

pharmacoeconomics

intellectual property