Fundamentals

When you feel the subtle shifts in your body ∞ the fatigue that settles in too early, the metabolic resistance that diet and exercise alone cannot seem to overcome ∞ it is easy to feel isolated in that experience. Your personal health journey is a deeply individual one, yet the tools available to support it are shaped by immense global forces.

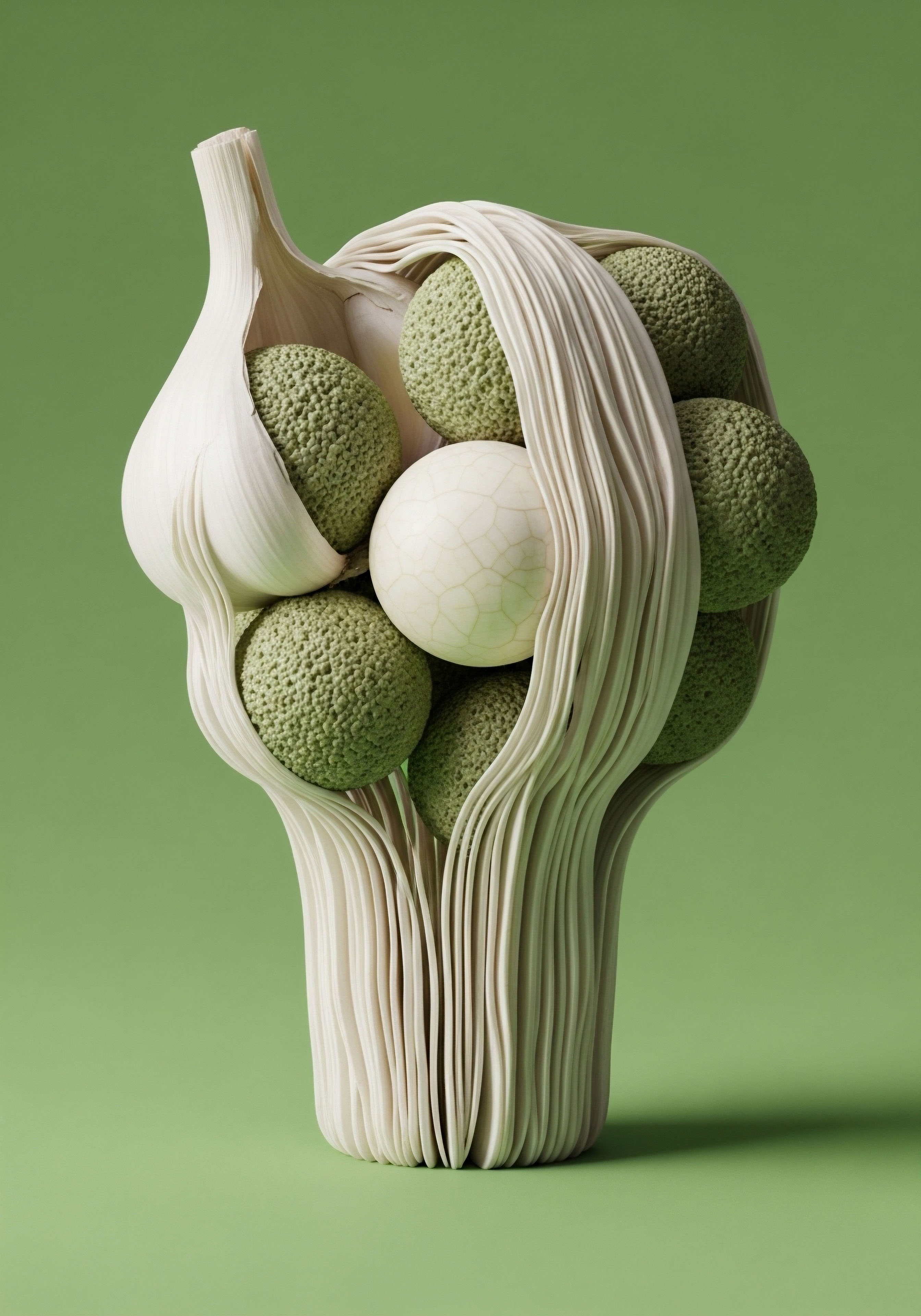

Understanding the commercial drivers behind peptide development, particularly in a powerhouse like China, is to understand the very currents that will deliver the next generation of wellness protocols to your doorstep. It begins with a simple, powerful biological truth ∞ your body communicates using a language of precise molecules. Peptides are short chains of amino acids, the very building blocks of proteins, that act as highly specific messengers, carrying instructions that regulate countless physiological functions.

The immense scientific and commercial interest in peptides stems from this precision. They can be designed to mimic or modulate the body’s own signaling molecules, offering a way to restore function with remarkable accuracy. This is where your personal experience connects with global economics.

The rising incidence of metabolic disorders, such as type 2 diabetes and obesity, alongside a global population increasingly focused on longevity and optimized wellness, has created a profound and urgent need. This need is the primary engine driving development. Commercial markets are, at their core, a response to collective human needs. The demand for more effective solutions for these conditions has sent a clear signal to the global biopharmaceutical industry, and China has positioned itself to be the central responder.

The Human Need behind the Market

The story of peptide development in China is a story of supply meeting a vast and growing demand. Consider the explosive growth in awareness around GLP-1 agonists, peptides that regulate blood sugar and satiety. Their effectiveness in managing diabetes and weight has been transformative for millions.

This clinical success creates a powerful commercial incentive. Chinese pharmaceutical companies and manufacturing organizations saw this need and began a rapid, strategic expansion of their capabilities to produce these complex molecules. This involves building highly specialized laboratories and recruiting top scientific talent, all underwritten by the knowledge that a healthier, more functional population is the ultimate return on investment.

The development of therapeutic peptides is driven by a global demand for more precise interventions in chronic disease and wellness optimization.

Supportive government policies and a deep national expertise in chemical engineering have further catalyzed this growth. The country’s ability to scale complex manufacturing processes efficiently means that these advanced therapies can potentially be produced at a lower cost, making them more accessible to a wider population globally.

This intersection of scientific capability, industrial capacity, and pressing public health requirements is the foundational commercial consideration. It is a recognition that restoring hormonal balance and metabolic function is a fundamental component of modern healthcare.

Why Peptides Represent a New Approach

Peptide therapies represent a sophisticated evolution in medicine. They are designed to work with the body’s own systems. Their high specificity often translates to fewer off-target effects compared to traditional small-molecule drugs. This biological elegance is what makes them so compelling for both patients and developers.

For individuals seeking to fine-tune their health, whether addressing a diagnosed condition or pursuing proactive anti-aging protocols, peptides offer a level of precision that was previously unavailable. The commercial landscape in China is rapidly reorienting to build the infrastructure necessary to deliver on this promise, from research and development in cities like Shanghai to large-scale production across the country.

Intermediate

To appreciate the commercial engine driving peptide development in China, one must look at the specialized ecosystem that has been constructed to support it. The key players in this space are Contract Development and Manufacturing Organizations (CDMOs), highly sophisticated firms that provide the scientific and industrial backbone for bringing a peptide from a laboratory concept to a clinical-grade therapeutic.

These organizations are the nexus where investment, scientific innovation, and large-scale production converge. Their commercial decisions are dictated by a clear understanding of global therapeutic demand, patent landscapes, and manufacturing technology.

The most significant commercial driver has been the success of blockbuster peptide drugs on the global market, particularly in the metabolic space. When a drug like semaglutide or tirzepatide demonstrates profound clinical efficacy, it creates a ripple effect. Pharmaceutical companies worldwide seek to develop their own novel peptides or create bioequivalent generic versions once patents expire.

Chinese CDMOs have strategically positioned themselves to capture this business. They do this by investing heavily in the core technologies of peptide synthesis, primarily Solid-Phase Peptide Synthesis (SPPS), which allows for the precise, step-by-step construction of these complex molecules.

The Central Role of Manufacturing Technology

The choice of manufacturing technology is a critical commercial consideration. It directly impacts cost, purity, and the ability to scale production from milligrams in a research lab to kilograms for a global market. The proficiency of Chinese firms in this area is a primary competitive advantage.

- Solid-Phase Peptide Synthesis (SPPS) ∞ This is the workhorse technology for peptide manufacturing. The process involves building a peptide chain on a solid resin support. Chinese CDMOs have achieved massive scale in SPPS, with some firms operating reactor volumes in the tens of thousands of liters. This capacity is a direct response to the demand for GLP-1 agonists and other popular peptides.

- Liquid-Phase Peptide Synthesis (LPPS) ∞ For very large-scale production of certain peptides, LPPS can be more cost-effective. It is a more traditional chemical synthesis method that is being modernized by leading Chinese companies. The ability to offer both SPPS and LPPS provides flexibility to meet diverse client needs, from clinical trial batches to full-scale commercial supply.

- Automation and Digitalization ∞ Leading facilities in China utilize digital operating systems and automated solvent delivery. This enhances production consistency, reduces the potential for human error, and shortens production cycles, all of which are compelling commercial advantages for their clients.

Strategic investments in advanced manufacturing capacity are the primary way Chinese firms compete in the global peptide market.

The following table provides a simplified overview of how these manufacturing capabilities translate into commercial offerings by leading CDMOs in China.

| Company | Key Peptide Capabilities | Primary Commercial Focus |

|---|---|---|

| WuXi AppTec (TIDES) | Large-scale SPPS (32,000L+ reactor volume), LPPS, expertise in oligonucleotides and conjugates. | Providing integrated research, development, and manufacturing services for global pharmaceutical companies, from preclinical to commercial stages. |

| Asymchem | Expanding SPPS capacity (over 10,000L), developing advanced LPPS technologies. | Focusing on peptide CDMO services, with an emphasis on cost-control and technological innovation to capture the GLP-1 market. |

| Hybio Pharmaceutical | Active Pharmaceutical Ingredient (API) production, generic peptide development. | Supplying both finished peptide drugs for the domestic market and APIs for international clients. |

What Is the Impact of Personalized Medicine on the Market?

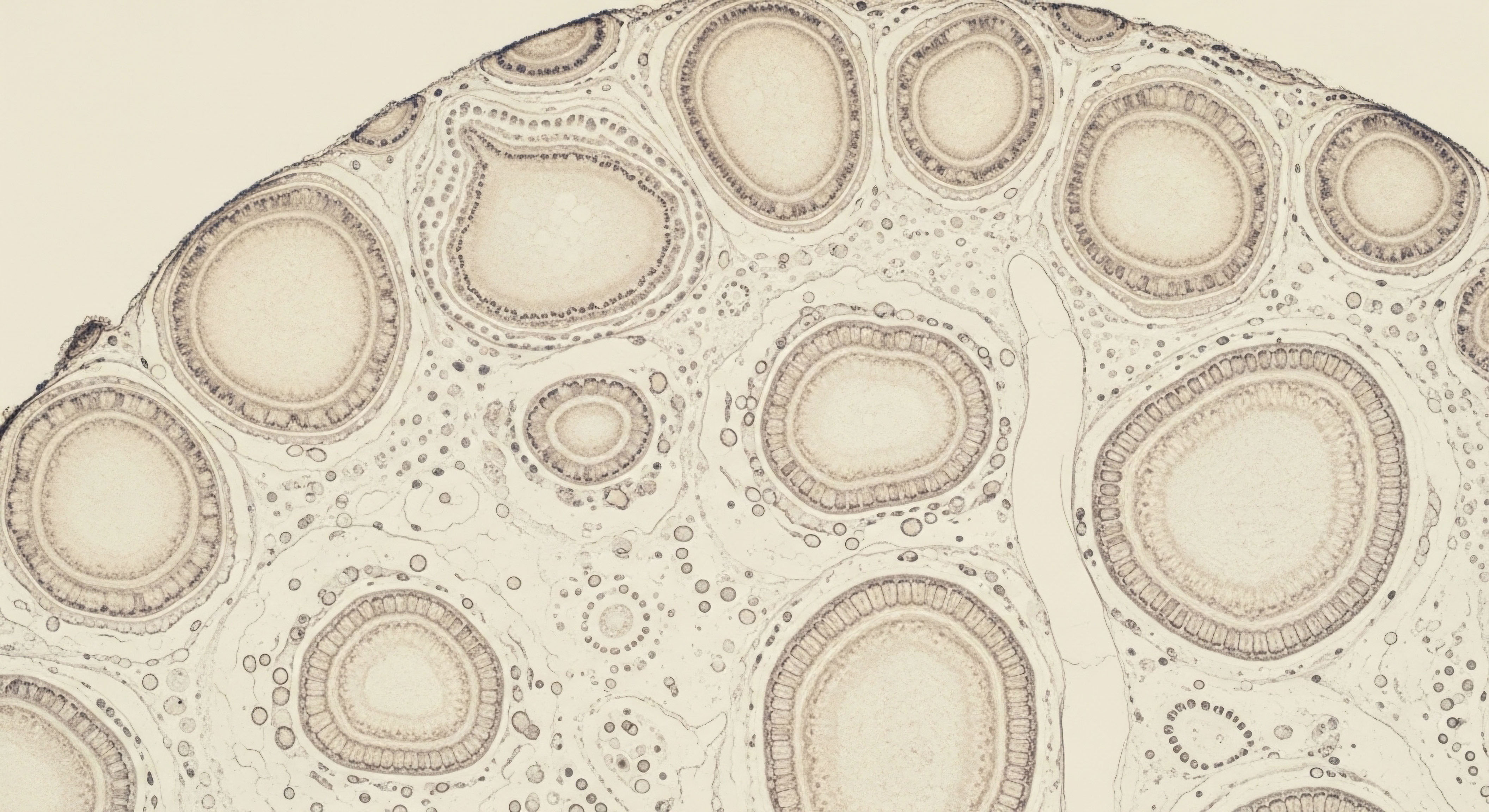

Beyond the high-volume production of blockbuster peptides, a significant commercial driver is the rise of personalized medicine. This includes custom peptide synthesis for applications like neoantigen cancer vaccines, where a therapy is tailored to the unique genetic makeup of a patient’s tumor.

This is a high-value, lower-volume market that requires exceptional scientific expertise and manufacturing agility. Chinese companies are actively developing capabilities in this area, recognizing that the future of therapeutics lies in personalization. This diversification from bulk manufacturing to highly specialized, custom synthesis represents a maturing of the market, driven by the clinical need for more precise and individualized treatments.

Academic

A systemic analysis of the commercial drivers for peptide development in China reveals a sophisticated industrial strategy predicated on capturing value across the entire pharmaceutical supply chain. This strategy moves far beyond simple cost arbitrage in manufacturing. It represents a coordinated effort, involving government policy, private investment, and academic research, to establish a dominant position in a high-value sector of biotechnology.

The core commercial consideration is the strategic exploitation of the predictable life cycle of pharmaceutical products, from the development of novel therapeutics to the eventual production of generics.

The initial catalyst was the global clinical and commercial success of peptide therapeutics, which validated the market. Chinese firms, supported by a strong foundation in chemistry and process engineering, recognized the opportunity to become the world’s manufacturing backbone for these molecules.

This is evidenced by the massive capital expenditures on increasing Solid-Phase Peptide Synthesis (SPPS) reactor volume by companies like WuXi AppTec and Asymchem. This build-out is a direct commercial response to the forecasted multi-billion dollar demand for GLP-1 agonists and other metabolic peptides over the next decade. It is a calculated investment in infrastructure designed to secure long-term manufacturing contracts from global pharmaceutical giants.

From API Supplier to Innovation Partner

The second layer of the commercial strategy involves moving up the value chain. While the production of Active Pharmaceutical Ingredients (APIs) for export is a lucrative business, the ultimate goal is to foster domestic innovation. Government initiatives and the availability of venture capital are fueling a burgeoning ecosystem of biotech startups focused on discovering novel peptide candidates.

This is where the commercial considerations become more complex, involving intellectual property (IP) strategy, clinical trial design, and navigating global regulatory pathways. The rise of Chinese firms filing Drug Master Files (DMFs) with the US FDA at a higher rate than their Western counterparts for peptide APIs is a clear indicator of this strategic shift.

China’s peptide strategy integrates large-scale manufacturing with a growing focus on domestic research and development to create a self-sustaining innovation ecosystem.

The following table outlines the key commercial decision points at different stages of the peptide development cycle within the Chinese context.

| Development Phase | Key Commercial Consideration | Example Action in Chinese Market |

|---|---|---|

| Discovery & Preclinical | Target Selection and IP Generation | Investment in AI-driven drug discovery platforms to identify novel peptide targets for metabolic or oncologic diseases. |

| Process Development & Scale-Up | Cost of Goods (COGS) and Purity | Optimizing SPPS and LPPS protocols to reduce solvent use and increase yield, a core competency of Chinese CDMOs. |

| Clinical Trials (Phase I-III) | Regulatory Approval and Market Access | Designing trials to meet both NMPA (China) and FDA/EMA (Global) standards to maximize market potential. |

| Commercial Manufacturing | Supply Chain Security and Capacity | Massive expansion of reactor capacity to ensure uninterrupted supply for blockbuster drugs and secure long-term contracts. |

| Post-Patent Exclusivity | Generic/Biosimilar Competition | Developing high-quality, cost-competitive generic versions of established peptides to capture market share. |

How Do Systemic Health Needs Shape Long Term Investment?

The long-term commercial strategy is deeply intertwined with China’s domestic public health challenges. An aging population and the high prevalence of chronic conditions like diabetes, cardiovascular disease, and cancer create a massive, sustained domestic market for new therapies. Therefore, investment in peptide development is also a matter of national health security and economic policy.

By building a world-class domestic peptide industry, the nation ensures a stable supply of critical medicines while also creating a powerful engine for economic growth through high-value exports. This dual-driver model, serving both domestic needs and global markets, provides a resilient and compelling foundation for sustained commercial development in the decades to come.

Furthermore, the industry is diversifying into emerging fields like peptide-drug conjugates (PDCs) for targeted cancer therapy and even cosmeceuticals. This demonstrates a sophisticated understanding of platform technology. The expertise built in synthesizing peptides for one therapeutic area can be leveraged to enter adjacent markets, maximizing the return on the initial technological and capital investment. This strategic diversification is a hallmark of a mature and commercially astute industrial sector.

References

- “Riding GLP-1 wave, China set to lead the charge in peptide industry growth.” Kr Asia, 26 June 2024.

- “Tag-Assisted Peptide Synthesis (TAPS) Services Market Poised.” openPR.com, 1 August 2025.

- “BioDuro boosts peptide production in China with new manufacturing plant.” Fierce Pharma, 13 January 2025.

- “Peptide Drug Discovery Market Growth and Restrain Factors Analysis Report.” openPR.com, 1 August 2025.

- Brooks, Kristin. “WuXi AppTec Triples Peptide Manufacturing Capacity.” Contract Pharma, 8 January 2024.

Reflection

Connecting Global Currents to Your Personal Biology

The journey to reclaim your vitality is deeply personal, rooted in the unique language of your own body. Yet, the tools and therapeutic options available to you are the result of a vast, interconnected global system of science, economics, and human need.

Understanding that the expansion of a manufacturing plant in Shanghai could one day influence the availability and cost of a therapy that restores your metabolic health is a powerful realization. It transforms you from a passive recipient of healthcare into an informed participant in your own wellness journey.

The knowledge of these large-scale commercial forces provides context for your choices and empowers you to ask more precise questions. It is the recognition that your individual path to wellness is part of a much larger human story of scientific progress and a collective desire for a longer, healthier life.

Glossary

peptide development

metabolic disorders

glp-1 agonists

solid-phase peptide synthesis

peptide synthesis

spps

liquid-phase peptide synthesis

lpps

personalized medicine

pharmaceutical supply chain

wuxi apptec