Fundamentals

Understanding the boundaries of workplace wellness programs begins with a simple, yet profound, acknowledgment of your personal health information’s protected status. Your biological data, from blood pressure readings to genetic predispositions, is shielded by law. The Americans with Disabilities Act (ADA) establishes a critical framework to ensure that your participation in any wellness initiative offered by your employer is genuinely voluntary.

This principle of voluntary participation is the bedrock upon which all incentive structures are built. It dictates that you cannot be compelled, coerced, or penalized for choosing not to engage in a program that involves medical examinations or asks questions about your health status. The law is designed to prevent a situation where the financial reward is so substantial that it effectively becomes a penalty for those who decline, thereby making participation an economic necessity rather than a free choice.

At the heart of this regulatory framework is a specific financial threshold. For a wellness program that includes disability-related inquiries or medical exams to be considered voluntary, any financial incentive is generally limited to 30 percent of the total cost of self-only health insurance coverage. This figure represents a carefully calibrated balance.

It is intended to be significant enough to encourage participation without being so high as to be coercive. Think of it as a guardrail, ensuring that the decision to share personal health information remains firmly in your hands. This limit applies whether the program simply rewards you for participating, such as by filling out a health risk assessment, or if it is a health-contingent program that rewards you for achieving a specific health outcome, like lowering your cholesterol.

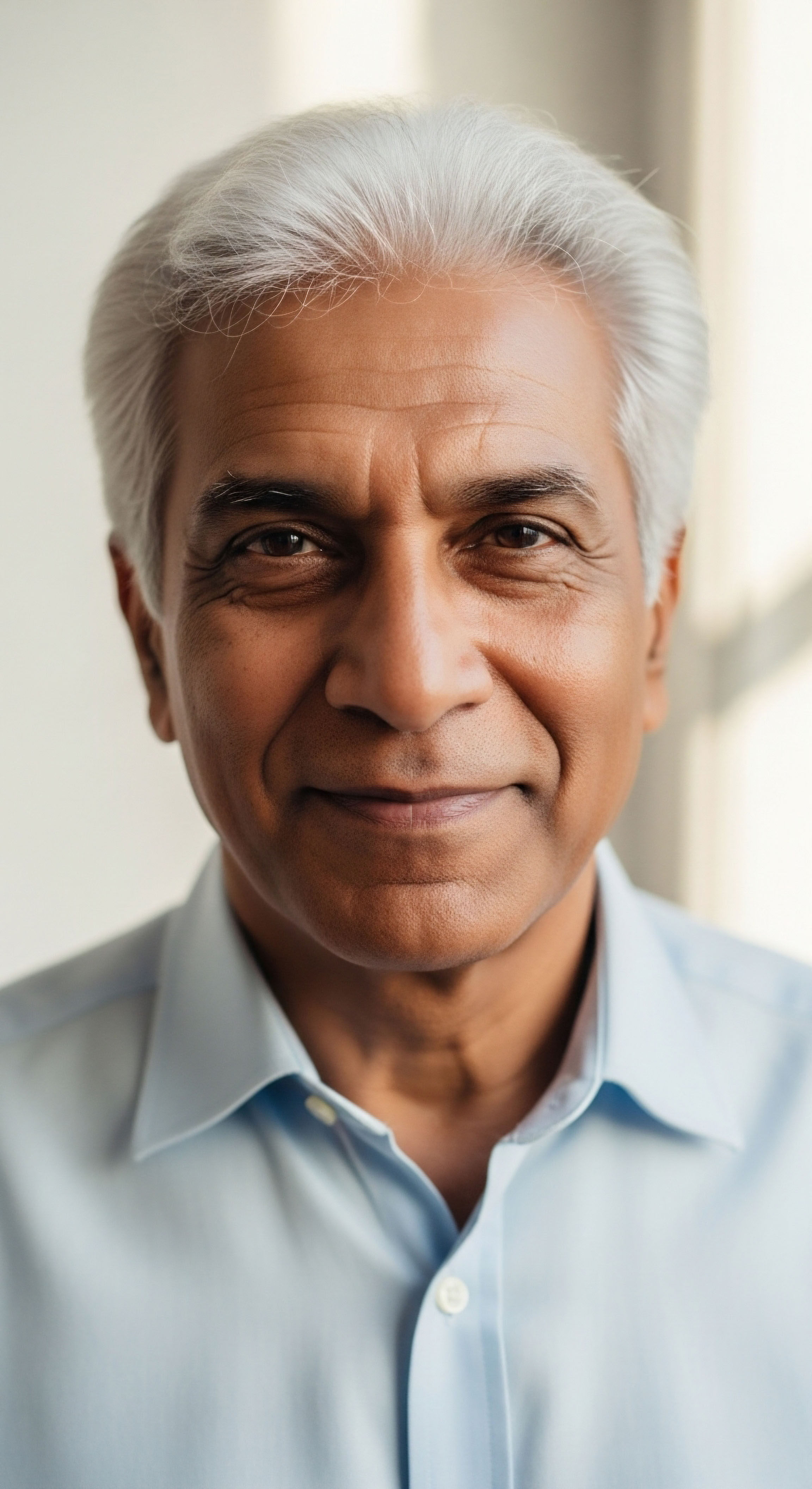

The ADA ensures your participation in workplace wellness programs is voluntary by setting clear financial limits on incentives.

The core concept is to maintain your autonomy over your health data. The structure of these regulations recognizes that true wellness cannot be achieved through mandates or pressure. Instead, it must be an empowered choice.

By setting a clear ceiling on incentives, the ADA seeks to preserve an environment where you can engage with employer-sponsored health initiatives based on their intrinsic value to your well-being, not because of overwhelming financial pressure. This ensures that the path to better health within a corporate structure respects your individual agency and right to privacy, forming a foundational trust between you and your employer’s wellness offerings.

Intermediate

Delving deeper into the mechanics of wellness program incentives requires a precise understanding of how the 30 percent limit is calculated and applied. This is not merely a percentage of the premium you pay, but 30 percent of the total cost of self-only coverage, which includes both the portion you pay and the portion your employer contributes.

This distinction is vital because it establishes a consistent, transparent basis for the incentive’s value, independent of how premium costs are shared. The regulation applies this 30 percent cap to both primary types of wellness programs that involve medical inquiries.

Differentiating Program Types

The two main categories of wellness programs governed by these rules are participatory and health-contingent. Understanding their differences is key to grasping the nuances of the incentive limits.

- Participatory Programs ∞ These programs reward you for simply taking part in a health-related activity. An example is receiving a gift card for completing a health risk assessment (HRA) or undergoing a biometric screening. The incentive is not tied to the results of these tests. The ADA’s 30% limit applies here because these activities involve disability-related inquiries and medical examinations.

- Health-Contingent Programs ∞ These programs require you to meet a specific health standard to earn a reward. For instance, you might receive a discount on your premium if you achieve a certain BMI or blood pressure target. These are also subject to the 30% incentive limit under the ADA.

The Intersection with HIPAA and GINA

The regulatory landscape is further shaped by the Health Insurance Portability and Accountability Act (HIPAA) and the Genetic Information Nondiscrimination Act (GINA). While the ADA sets the 30% limit for programs involving medical exams, HIPAA also has rules for health-contingent wellness programs.

For smoking cessation programs, HIPAA allows for a higher incentive, up to 50% of the cost of self-only coverage. However, a critical distinction exists ∞ if the smoking cessation program requires a biometric screening or other medical test to verify tobacco use, the lower 30% ADA limit applies. If the program only requires you to self-report your smoking status, the higher 50% limit may be permissible.

GINA introduces another layer of protection, focusing on genetic information, which includes family medical history. Under GINA, employers are generally prohibited from offering incentives for you to provide your genetic information. However, there is a specific rule regarding spouses.

An employer can offer an incentive to an employee for their spouse’s participation in a wellness program, even if it involves the spouse providing health information (excluding genetic information). This spousal incentive is also capped, limited to 30 percent of the total cost of self-only coverage.

The 30% incentive cap is based on the total cost of self-only health coverage and applies to programs requiring medical data, with specific rules for spousal participation and smoking cessation.

How Are Incentive Limits Applied in Practice?

To illustrate the application of these rules, consider the following table which outlines different scenarios and their corresponding incentive limits. This demonstrates how the type of program and the nature of the required information dictate the permissible financial reward.

| Wellness Program Activity | Applicable Law | Maximum Incentive Limit |

|---|---|---|

| Completing a Health Risk Assessment | ADA | 30% of total cost of self-only coverage |

| Achieving a target cholesterol level | ADA/HIPAA | 30% of total cost of self-only coverage |

| Participating in a smoking cessation program (self-attestation) | HIPAA | 50% of total cost of self-only coverage |

| Undergoing a biometric screening to test for nicotine | ADA | 30% of total cost of self-only coverage |

| Spouse completes a Health Risk Assessment | GINA/ADA | 30% of total cost of self-only coverage |

Academic

The regulatory landscape governing workplace wellness incentives is a dynamic and contested space, reflecting a deep-seated tension between two distinct public policy goals. On one hand, public health policy, embodied in the Affordable Care Act (ACA), seeks to encourage behaviors that reduce healthcare costs.

On the other, civil rights law, represented by the ADA and GINA, aims to protect individuals from discrimination and coercive medical inquiries. The specific incentive limits are the focal point of this tension, and their history reveals a complex interplay of legislative action, regulatory interpretation, and judicial review.

The Evolution from Safe Harbor to Regulatory Void

In 2016, the Equal Employment Opportunity Commission (EEOC) issued rules that seemed to harmonize these competing interests. These rules established that wellness programs were considered “voluntary” under the ADA and GINA if the incentive did not exceed 30% of the cost of self-only health coverage.

This created a “safe harbor” for employers, providing a clear, quantifiable standard. This standard applied to both participatory and health-contingent programs, offering a unified framework. However, this framework was challenged in court by the AARP, which argued that an incentive of this magnitude was coercive and effectively rendered participation involuntary for many employees, thus violating the spirit of the ADA.

The U.S. District Court for the District of Columbia agreed with the AARP, finding the EEOC had not provided a sufficient justification for why the 30% figure rendered a program voluntary. The court vacated the incentive limit portion of the rules, effective January 1, 2019.

This judicial action plunged employers into a state of regulatory uncertainty, as there was no longer a clear, legally defensible safe harbor for wellness program incentives. The clear line had been erased, leaving a void where employers had to navigate the definition of “voluntary” without explicit EEOC guidance.

The vacating of the 2016 EEOC rules by a federal court created a significant regulatory gap, removing the clear 30% safe harbor for wellness incentives.

The Proposed “de Minimis” Standard and Its Implications

In an attempt to fill this void, the EEOC issued new proposed rules in January 2021. These proposals represented a significant philosophical shift. For most wellness programs that require medical exams or disability-related inquiries (i.e. participatory programs), the proposed rules stated that employers could offer no more than a “de minimis” incentive.

A de minimis incentive was described with examples like a water bottle or a gift card of modest value, a stark departure from the previous 30% rule. This signaled a prioritization of the ADA’s anti-coercion principles over the ACA’s health promotion goals.

However, the 2021 proposed rules included a significant exception. They preserved the 30% incentive limit for health-contingent wellness programs that are part of, or qualify as, a group health plan and comply with HIPAA’s existing framework. This created a bifurcated system where participatory programs were limited to trivial rewards, while outcome-based programs could offer substantial incentives.

Before these proposed rules could be finalized, they were withdrawn by the new administration in February 2021, leaving employers once again in a state of limbo.

This history reveals the core of the regulatory conflict. The ADA’s primary concern is preventing employers from gaining access to an employee’s protected health information through undue financial pressure. A high incentive, from this perspective, is inherently coercive. Conversely, HIPAA’s framework, as amended by the ACA, views these incentives as valuable tools to encourage healthier lifestyles and control healthcare spending.

The unresolved status of these rules means that employers currently operate in a gray area, balancing the desire to promote wellness against the legal risks associated with incentives that could be deemed involuntary.

The following table summarizes the shifting legal standards, illustrating the journey from a clear safe harbor to the current state of uncertainty.

| Regulatory Period | Standard for Participatory Programs (with medical exams) | Standard for Health-Contingent Programs |

|---|---|---|

| 2016 EEOC Final Rule | 30% of self-only coverage cost | 30% of self-only coverage cost |

| Post-AARP v. EEOC (2019-Present) | No specific EEOC safe harbor (“Voluntary” standard) | No specific EEOC safe harbor (“Voluntary” standard) |

| January 2021 EEOC Proposed Rule (Withdrawn) | De minimis incentive only | Up to 30% of coverage cost (if part of a group health plan) |

References

- Winston & Strawn LLP. “EEOC Issues Final Rules on Employer Wellness Programs.” 17 May 2016.

- Sequoia. ” EEOC Releases Proposed Rules on Employer-Provided Wellness Program Incentives.” 20 January 2021.

- Miller, Stephen. “EEOC Proposes ∞ Then Suspends ∞ Regulations on Wellness Program Incentives.” SHRM, 12 February 2021.

- K&L Gates. “Well Done? EEOC’s New Proposed Rules Would Limit Employer Wellness Programs to De Minimis Incentives ∞ with Significant Exceptions.” 12 January 2021.

- Mercer. “EEOC Proposed Rules on Wellness Incentives.” 2015.

- U.S. Equal Employment Opportunity Commission. “Questions and Answers ∞ EEOC’s Final Rule on Employer Wellness Programs and the Genetic Information Nondiscrimination Act.” 16 May 2016.

- AARP v. U.S. Equal Employment Opportunity Commission, 267 F. Supp. 3d 14 (D.D.C. 2017).

- U.S. Department of Labor. “Fact Sheet ∞ The Affordable Care Act & Wellness Programs.”

Reflection

The regulations governing workplace wellness are more than a set of rules; they are a reflection of a larger conversation about the relationship between personal health, privacy, and employment. The information presented here provides a map of the legal framework, but you are the one navigating the terrain of your own body and your own choices.

As you consider these programs, the essential question moves from “What is allowed?” to “What is right for me?” The knowledge of these limits is a tool, empowering you to assess any wellness offering with clarity. It allows you to see past the financial incentive and evaluate the program on its merits, ensuring your path toward well-being is one you choose with confidence and full agency.

Glossary

workplace wellness

voluntary participation

wellness program

health risk assessment

wellness program incentives

self-only coverage

wellness programs that

wellness programs

incentive limits

participatory programs

risk assessment

health-contingent programs

incentive limit

genetic information nondiscrimination act

smoking cessation

genetic information

equal employment opportunity commission

safe harbor