Fundamentals

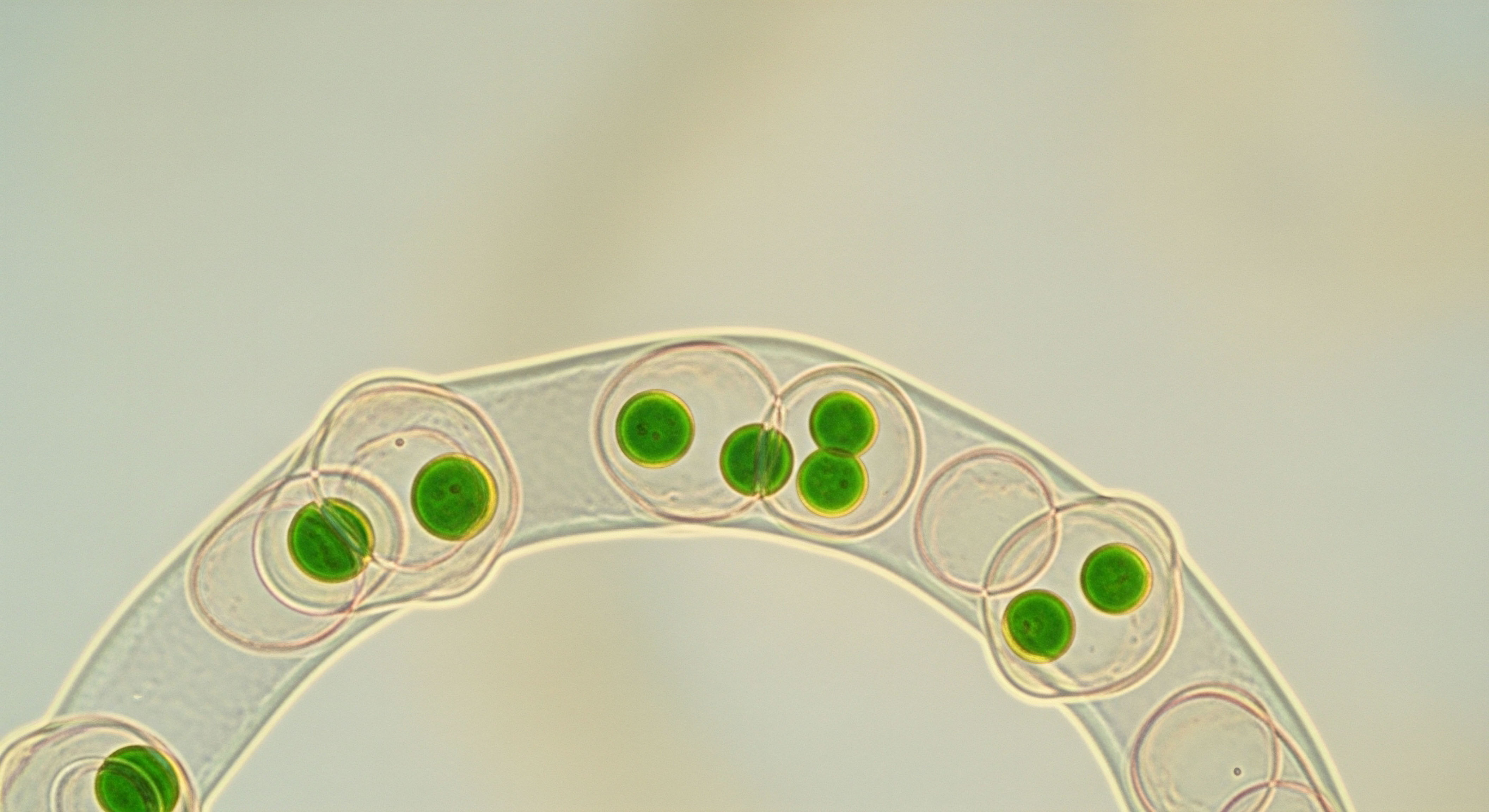

Entering the Chinese market with a new diagnostic tool can feel like a physician meeting a new patient for the first time. There is a vast amount of information to process, a unique history to understand, and a complex system of internal communications that is not immediately apparent. Your diagnostic kit, a product of meticulous science and engineering, is now an unknown variable being introduced into a deeply complex and self-regulating biological environment.

The initial challenge is one of translation and acclimatization. The objective is to understand the specific physiology of this market, its internal language of regulation, and the established pathways that govern the acceptance or rejection of new entrants.

The system’s first line of defense is its regulatory framework, managed by the National Medical Products Administration (NMPA). This body functions like a sophisticated immune system, with specific protocols for identifying, classifying, and approving any new element introduced into the healthcare environment. A foreign manufacturer must first learn to communicate effectively with this system.

This involves presenting data and documentation in a very precise format, adhering to a classification structure that determines the level of scrutiny the product will face. Misinterpreting these initial signals or failing to provide the correct information can lead to significant delays, akin to a key that does not quite fit the lock on a cellular receptor.

The Market’s Unique Metabolism

The Chinese diagnostic market possesses a rapid and distinct metabolic rate, driven by intense local competition and government policies favoring domestic innovation. For a foreign manufacturer, this environment presents a dynamic where speed and adaptability are paramount. The market consumes and processes new technologies quickly, and domestic companies are often deeply integrated into the local hospital networks and supply chains.

These established relationships form a kind of circulatory system that can be difficult for an outside entity to access. Understanding this local metabolism is key to finding a sustainable niche.

A foreign diagnostic kit’s journey into China is an exercise in understanding the market’s unique regulatory biology and competitive metabolism.

Several key participants influence this environment, each playing a specific role in the lifecycle of a diagnostic product. Successfully navigating this space requires an appreciation for how these entities interact.

- The NMPA ∞ This is the central nervous system of medical device regulation. Its decrees and guidelines dictate the pathways for all products, from initial application to post-market surveillance.

- Local Distributors ∞ These are the vascular network, responsible for carrying products to hospitals and laboratories. Their existing relationships and logistical capabilities are indispensable for reaching end-users.

- Key Opinion Leaders (KOLs) ∞ Influential clinicians and researchers function as signaling molecules. Their validation and acceptance of a new technology can significantly accelerate its adoption by the broader medical community.

- Domestic Manufacturers ∞ These are the native flora of the ecosystem. They are highly adapted to the local environment, often with cost advantages and strong government support, presenting a constant competitive pressure.

Ultimately, the foundational challenge is to see the Chinese market not as a simple commercial opportunity, but as a living system. It requires a diagnostic approach, where the manufacturer must first observe, learn, and adapt its strategy to the specific biological realities of the environment before expecting its product to be accepted and integrated.

Intermediate

Once a foreign manufacturer grasps the foundational concept of the Chinese market as a complex organism, the next step involves a deeper examination of its specific functional pathways. This means moving from a general understanding to a detailed procedural analysis of the core regulatory and clinical processes. The central mechanism governing market access is the NMPA registration process, a multi-stage gauntlet that functions as the market’s primary immunological checkpoint. Each stage is designed to test the safety, efficacy, and suitability of the diagnostic kit for the Chinese population.

How Does the NMPA Classify Diagnostic Kits?

The NMPA employs a risk-based classification system for all in-vitro diagnostics (IVDs), which dictates the entire regulatory pathway. This classification is the first critical diagnosis the NMPA makes about a product, and it determines the stringency of the subsequent evaluation. Understanding your product’s classification is the single most important step in planning a successful market entry strategy.

The system is divided into three classes, with Class I representing the lowest risk and Class III the highest. This hierarchy directly correlates with the amount of data, time, and resources required for approval.

| Device Class | Risk Level | Examples | Regulatory Pathway |

|---|---|---|---|

| Class I | Low | Culture media, sample buffers | Filing/notification system with minimal documentation. |

| Class II | Medium | Most chemistry reagents, calibrators, quality control materials | Requires technical dossier, type testing in a Chinese lab, and often clinical data. |

| Class III | High | Kits for blood screening, cancer biomarkers, infectious diseases | Most stringent path, requiring extensive clinical trials within China to prove efficacy on the local population. |

The Clinical Trial Gauntlet

For Class II and particularly Class III devices, the requirement for in-country clinical trials is a significant hurdle. These trials are not simply a formality; they are a rigorous process designed to validate the diagnostic kit’s performance specifically on Chinese patients. This presents several distinct challenges. First, there is the logistical complexity of identifying and contracting with qualified clinical sites and principal investigators.

Second, the trial protocols must be designed to meet the NMPA’s exacting standards, which may differ from those of the FDA or EMA. Finally, the data generated must be robust and statistically significant, demonstrating that the kit performs reliably within the genetic and epidemiological context of the Chinese population. This process is a profound resource commitment, demanding both capital and time.

The NMPA’s requirement for in-country clinical trials functions as a biological stress test, ensuring a product is adapted to the specificities of the Chinese patient population.

The procedural steps for navigating this system are sequential and unforgiving of error. A misstep at any stage can result in a complete reset of the process.

- Product Classification ∞ The manufacturer must first determine the correct risk class for their IVD, as this defines all subsequent steps. An incorrect classification can lead to the rejection of the entire submission.

- Type Testing ∞ The product must be sent to an NMPA-accredited laboratory in China for type testing. This process verifies that the product’s performance matches the specifications claimed by the manufacturer. It is a mandatory quality control checkpoint.

- Clinical Trial Execution ∞ For higher-risk devices, a clinical trial must be conducted in China. This involves gaining ethics committee approval, enrolling patients, and collecting data according to a pre-approved plan.

- Dossier Submission and Review ∞ A comprehensive technical dossier, including all manufacturing details, type testing reports, and clinical data, is submitted to the NMPA for review. This is an intensive paper-based and electronic audit of the product’s entire lifecycle.

- Approval and Post-Market Surveillance ∞ If the review is successful, the NMPA issues a registration certificate. The manufacturer’s obligations continue, with requirements for post-market surveillance and reporting of any adverse events.

Beyond these formal procedures, foreign manufacturers often face the challenge of the language barrier. All documentation, from technical specifications to clinical trial data, must be submitted in Mandarin. Nuances lost in translation can lead to misunderstandings and rejections, making expert local regulatory partners an essential component of the market entry team.

Academic

A sophisticated analysis of the challenges facing foreign diagnostic kit manufacturers in China requires moving beyond procedural checklists to a systems-biology perspective. The market is not a static set of rules but a dynamic ecosystem where regulatory policy, intellectual property Meaning ∞ The unique, protected body of knowledge, methodologies, and innovations derived from research and clinical practice within the domain of hormonal health and wellness. regimes, and local competitive pressures interact in a complex feedback loop. The most profound challenge lies at the intersection of regulatory data demands and the persistent vulnerability of intellectual property (IP), a dynamic that is heavily modulated by China’s industrial policy of promoting domestic champions.

What Is the True Cost of Regulatory Transparency?

The NMPA’s demand for extensive, granular data during the registration process for Class II and III IVDs serves a dual purpose. On a surface level, it is a legitimate public health function to ensure product safety and efficacy. On a deeper, systemic level, the process of generating this data—including detailed manufacturing processes, reagent formulations, and raw material specifications—creates a repository of highly sensitive information.

For a foreign manufacturer, submitting this data to a government body in a market known for aggressive IP infringement creates a significant strategic vulnerability. This is the central paradox ∞ the price of market access is the disclosure of the very innovations that constitute a company’s competitive advantage.

This situation is exacerbated by the structure of the type testing and clinical trial processes. During mandatory type testing in Chinese labs, the product is disassembled, analyzed, and benchmarked. While ostensibly for quality control, this provides an opportunity for detailed reverse-engineering.

Similarly, clinical trials Meaning ∞ Clinical trials are systematic investigations involving human volunteers to evaluate new treatments, interventions, or diagnostic methods. require collaboration with local hospitals and investigators, creating multiple nodes where proprietary information about the kit’s performance characteristics and underlying technology can be exposed. This forced transparency can inadvertently accelerate the development of “bio-similar” or “me-too” products by local competitors, who can leverage this information to shorten their own R&D cycles.

Intellectual Property Protection a Permeable Shield

While China has made significant strides in strengthening its patent laws, the enforcement and practical application of these laws in the medical device sector remain a critical challenge. The IP protection framework can be viewed as a semi-permeable membrane; it offers a degree of protection, but sophisticated local competitors have developed methods to diffuse through or bypass these barriers. The table below outlines common IP strategies and their inherent limitations within the Chinese context.

| Strategy | Description | Systemic Limitation |

|---|---|---|

| Patent Filing | Filing for invention and utility model patents in China to protect novel aspects of the kit. | Enforcement can be slow and costly. Local courts may lack technical expertise, and damages awarded are often insufficient to deter infringement. |

| Trade Secrets | Protecting key manufacturing processes or reagent formulas as proprietary secrets. | Highly vulnerable during the mandatory NMPA data submission and type testing processes, where disclosure is required for registration. |

| Defensive Publication | Proactively publishing non-core innovations to create prior art, preventing others from patenting them. | Does not protect the core innovation and can reveal strategic direction to competitors. |

| Complex Design | Engineering the kit with integrated hardware/software components that are difficult to replicate. | Increases cost and may be circumvented by competitors who develop alternative technical solutions to achieve the same diagnostic end. |

The core academic challenge is managing the inherent conflict between the regulatory demand for total transparency and the strategic necessity of protecting proprietary innovation.

This entire system is influenced by powerful non-tariff barriers and industrial policies. The “Made in China 2025” initiative and subsequent policies explicitly prioritize the development of domestic high-tech industries, including medical devices. This translates into preferential treatment for local companies, such as faster review times, government subsidies, and favored access to the vast public hospital procurement system. For a foreign manufacturer, this means competing on an uneven playing field where the regulatory and economic environment is calibrated to favor domestic players.

The challenge is therefore not merely commercial or regulatory, but geopolitical. It requires a strategy that accounts for the powerful homeostatic mechanisms China employs to nurture its own industrial ecosystem, often at the expense of foreign entities.

References

- Li, Yan, and Wei Zhang. “Navigating the Regulatory Landscape of In Vitro Diagnostics in China ∞ A Comprehensive Review.” Journal of Global Health Regulations, vol. 8, no. 2, 2022, pp. 45-62.

- Chen, Jian. Intellectual Property in the Dragon’s Den ∞ Protecting Medical Technology in China. Cambridge University Press, 2021.

- Wang, Hui, et al. “Clinical Trial Design and Data Requirements for High-Risk IVD Reagents under NMPA Guidelines.” Clinical Chemistry and Laboratory Medicine, vol. 59, no. 3, 2021, pp. 112-130.

- Zhang, L. “The Evolution of China’s Medical Device Localization and Its Impact on Foreign Manufacturers.” Asia-Pacific MedTech Review, vol. 15, 2023, pp. 22-38.

- Anjoran, Renaud. “Quality Control for Medical Devices Made in China.” Journal of Medical Device Regulation, vol. 17, no. 4, 2020, pp. 15-21.

- The State Council of the People’s Republic of China. “Regulation on the Supervision and Administration of Medical Devices (Order No. 739).” 2021.

Reflection

The information presented here provides a map of the complex territory foreign diagnostic manufacturers must navigate in China. This map details the regulatory checkpoints, the competitive terrain, and the deep systemic currents that shape the market. Understanding this landscape is the first, essential step.

The journey itself, however, is a personal one for each organization. It requires a constant process of self-assessment, adaptation, and strategic calibration.

Consider your own organization’s core strengths and vulnerabilities. How does your technology align with the specific clinical needs of the Chinese population? What is your tolerance for risk, particularly concerning intellectual property?

Answering these questions honestly is the beginning of crafting a personalized strategy. The path to successful integration is one of deep preparation, strategic partnership, and a profound respect for the unique character of the system you seek to enter.