Fundamentals

Your journey toward understanding your body’s intricate systems begins with a feeling. It could be the persistent fatigue that sleep does not resolve, the subtle decline in physical performance, or the frustrating sense that your internal vitality has diminished. You seek answers, leading you to the world of metabolic health and hormonal optimization. In this search, you encounter the science of peptide therapies—small chains of amino acids that act as precise biological messengers, capable of instructing cells to heal, regenerate, and function optimally.

You learn about protocols involving substances like Sermorelin or Ipamorelin, which can support the body’s natural processes. This knowledge is empowering. It provides a map connecting your symptoms to underlying physiological mechanisms.

There is, however, a critical component of this map that remains unseen by most. The physical substance of these therapies, the actual molecules that will circulate within your body, have their own origin story. This story begins long before a sterile vial arrives at a clinic. It starts in highly specialized manufacturing facilities, and a significant portion of this global production capacity is located in China.

The regulations governing these facilities, the standards they must meet, and the national policies that dictate their operation are not distant abstractions. They are foundational variables in your personal health equation. The decisions made by the National Medical Products Administration (NMPA) in China, for instance, directly influence the purity, availability, and cost of the very compounds you might rely on to restore your biological function.

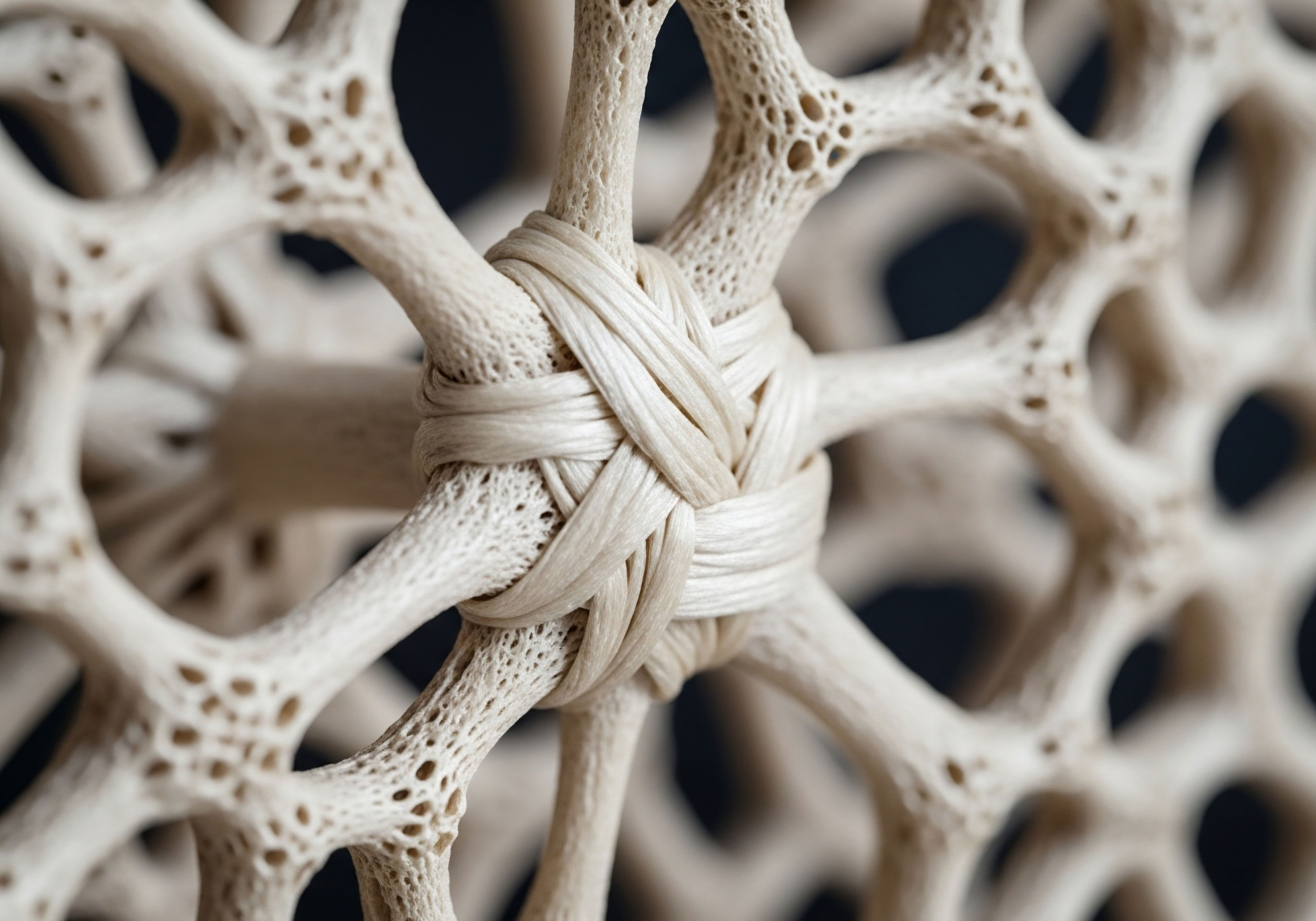

Understanding this connection is essential. The global pharmaceutical system is an interconnected web, and the primary molecule in any medication is called the Active Pharmaceutical Ingredient or API. For peptide therapies, the API is the peptide sequence itself.

China has become the world’s leading producer of many foundational APIs for generic medications and is rapidly expanding its capacity for complex molecules like peptides. This concentration of production means that any shift in Chinese industrial or regulatory policy creates ripples that are felt across the globe, eventually reaching the clinics and patients who depend on these therapies.

The Global Peptide Supply Chain

The journey of a therapeutic peptide is a complex multi-step process. It begins with basic chemical building blocks, the amino acids. These are linked together in precise sequences using sophisticated automated instruments called peptide synthesizers.

The resulting raw peptide must then undergo extensive purification to remove impurities, as even tiny variations can alter its biological effect or cause an unwanted immune response. Finally, it is formulated into a stable, sterile product under exacting conditions known as Good Manufacturing Practice (GMP), which are enforced by regulatory bodies like the U.S. Food and Drug Administration (FDA).

China’s role in this supply chain is dominant, particularly in the earlier stages of production, including the synthesis of raw peptide material. The country’s manufacturing prowess, developed over decades, allows for production at a scale and cost that is difficult to replicate elsewhere. Consequently, many pharmaceutical companies and compounding pharmacies around the world source their raw peptide API from Chinese manufacturers. This economic efficiency has made many advanced therapies more accessible.

It also creates a significant point of dependency. The long-term implications of this dependency are shaped by the direction of China’s own domestic regulations.

A nation’s industrial policy can directly influence the cellular health of a person half a world away.

What Are the Core Regulatory Pressures?

Two major forces are shaping the landscape of peptide manufacturing in China. The first is an internal push for higher quality and environmental stewardship. The Chinese government has implemented stricter environmental laws that compel manufacturers to invest in cleaner production technologies.

These measures are intended to create a more sustainable industrial base and improve public health. They can also increase operational costs and force smaller, non-compliant producers to exit the market, potentially consolidating production among larger, more advanced companies and affecting supply.

The second force is the increasing stringency of international standards. Regulatory bodies like the FDA and the European Medicines Agency (EMA) are continuously elevating their requirements for drug purity and safety. For instance, recent FDA guidance for synthetic peptides suggests that any impurity present at a level above 0.10% should be assessed for potential immunogenicity, a standard even stricter than for many conventional small-molecule drugs. For a Chinese manufacturer wishing to export its products to Western markets, meeting these evolving, rigorous GMP standards is a necessity.

This dynamic creates a powerful incentive for Chinese firms to invest in cutting-edge quality control and production technology, aligning their domestic operations with global expectations. The interplay of these domestic and international pressures will ultimately define the future of peptide availability and innovation.

Intermediate

To appreciate the tangible effects of China’s peptide regulations, one must understand the distinction between different grades of peptides and the intricate logistics that bring them from a laboratory to a clinical setting. The peptides used in academic research to explore biological pathways are different from the highly purified, sterile compounds required for human therapeutic use. The latter must be produced under a globally recognized quality system known as Good Manufacturing Practice (GMP). This system governs every aspect of production, from the sourcing of raw materials to the training of personnel and the validation of purification methods, ensuring the final product is safe, pure, and potent.

China’s position in the global peptide market is complex. While the nation is a powerhouse in producing a vast quantity of raw chemical materials, its journey toward dominance in the high-stakes arena of GMP-grade therapeutic peptides is a more recent development. Historically, many Western companies would source raw, non-GMP peptide material from China and then conduct the final, costly purification and formulation steps in their own GMP-certified facilities. Today, that model is changing.

Major Chinese companies like WuXi AppTec are making massive investments to build and operate state-of-the-art GMP facilities that can handle the entire production process, from synthesis to sterile product, at a massive scale. This vertical integration is a strategic response to growing global demand and the tightening quality standards from international regulators.

How Do Regulatory Shifts Translate to Clinical Realities?

A regulatory change within China’s borders is not merely a legal or administrative event; it is a powerful market force with direct consequences for healthcare providers and the individuals they treat. These shifts can influence three critical areas ∞ cost, availability, and quality. A new environmental regulation, for example, might increase the cost of solvents used in purification, which translates to a higher price for the finished API. A government-mandated consolidation of the industry could reduce the number of suppliers, creating bottlenecks that lead to shortages of specific peptides like Tesamorelin Meaning ∞ Tesamorelin is a synthetic peptide analog of Growth Hormone-Releasing Hormone (GHRH). or CJC-1295.

Conversely, a government initiative to align with international GMP standards can have a profoundly positive impact on quality. By incentivizing manufacturers to adopt the most advanced analytical techniques for detecting impurities, these regulations can increase the safety and reliability of peptides sourced from China. The table below illustrates how a hypothetical regulatory shift—such as a new mandate for advanced impurity analysis—could ripple through the supply chain and ultimately affect a clinical protocol.

| Supply Chain Stage | Pre-Regulation Scenario | Post-Regulation Scenario (Mandated Advanced Purity) |

|---|---|---|

| API Manufacturer (China) |

Uses standard High-Performance Liquid Chromatography (HPLC) for purity testing. Some minor, structurally similar impurities may go undetected. |

Must invest in and validate Mass Spectrometry (MS) analysis for all batches. This identifies previously unseen impurities, increasing production costs but also quality assurance. |

| U.S. Compounding Pharmacy |

Receives API with a 99% purity certificate based on HPLC. Conducts its own standard identity and sterility testing. |

Receives API with a 99.5% purity certificate, including detailed MS data. The cost per gram of the API increases by 15%. The pharmacy has higher confidence in the material’s quality. |

| Wellness Clinic |

Sources a peptide like Ipamorelin/CJC-1295 from the compounding pharmacy at a stable price. Protocols are consistent. |

The cost of the compounded Ipamorelin/CJC-1295 increases. The clinic must decide whether to absorb the cost or adjust patient pricing. The clinical benefit is a reduced risk of adverse reactions from unknown impurities. |

| Individual Patient |

Receives therapy as part of a wellness protocol. The biological effect is generally positive, though occasional minor side effects are noted. |

May face a higher cost for the therapy. The trade-off is receiving a product with a higher, verifiable standard of purity, potentially leading to better outcomes and fewer side effects. |

The quality of a therapeutic peptide is not a feature; it is the entire basis of its biological function and safety.

Vulnerability of Specific Peptide Therapies

Not all peptides are created equal from a manufacturing standpoint. The length of the amino acid chain, its complexity, and the scale of demand all influence its production. Shorter, simpler peptides are easier to produce in large quantities, while longer, more complex ones require more sophisticated techniques and are more susceptible to impurity formation. This means that regulatory pressures or supply disruptions can disproportionately affect certain therapies.

The following list outlines several key peptides used in hormonal and metabolic health, along with their vulnerability to supply chain dynamics rooted in Chinese manufacturing:

- Sermorelin/Ipamorelin/CJC-1295 ∞ These are Growth Hormone Releasing Peptides (GHRPs) and Growth Hormone Releasing Hormones (GHRHs). Their popularity in anti-aging and wellness protocols means there is high demand. Their production is well-established, but the sheer volume required makes the supply chain sensitive to cost fluctuations in raw materials and solvents, many of which originate in China.

- Tesamorelin ∞ A longer, more complex GHRH analogue. Its intricate structure makes synthesis and purification more challenging and expensive. The production of such complex peptides is concentrated in fewer, highly specialized facilities. A regulatory shutdown of even one major producer could create a significant global shortage.

- PT-141 (Bremelanotide) ∞ A smaller peptide used for sexual health. While simpler to synthesize, its status as a niche therapeutic means fewer manufacturers produce it at GMP grade. This limited supplier base creates vulnerability; if a primary Chinese supplier alters its production priorities due to new domestic regulations, clinics worldwide could face availability issues.

- BPC-157 ∞ This peptide, often used for tissue repair and healing, exists in a grayer regulatory space. Much of the available supply is sold for “research purposes only,” with GMP-grade material being rarer and more expensive. Stricter Chinese regulations on chemical exports could severely curtail the availability of the raw material, impacting both research and the unapproved therapeutic use market.

The interconnectedness of this system demonstrates that the stability of personalized wellness protocols in the West is intrinsically linked to the industrial and regulatory climate in the East. Any long-term strategy for ensuring patient access to these therapies must account for this geopolitical and economic reality.

Academic

The long-term implications of China’s peptide therapy regulations extend beyond simple supply and demand dynamics, touching upon the foundational architecture of global pharmaceutical innovation, economic strategy, and risk management. An academic analysis reveals a complex interplay between state-driven industrial policy, the stringent technical demands of biochemical manufacturing, and the economic phenomenon of supply chain concentration risk. China’s ascent to a dominant position in API manufacturing was the result of deliberate state support, lower production costs, and a massive scaling of chemical engineering infrastructure. This has created a situation where, for many essential drug components, the global healthcare system relies on a single geographic region, a dependency that carries systemic risks.

From a systems-biology perspective, a therapeutic peptide is a highly specific informational molecule designed to interact with a complex biological network. Its efficacy is entirely dependent on its structural integrity and purity. The presence of synthesis-related impurities, such as deletions or insertions of amino acids, can create molecules that either fail to bind to the target receptor or, more problematically, act as antagonists or trigger off-target effects and immunogenic responses. The global regulatory trend, spearheaded by agencies like the FDA, is to demand ever-lower impurity thresholds.

This scientific necessity places immense pressure on the manufacturing process, requiring substantial capital investment in technologies like continuous purification and advanced mass spectrometry. China’s response to this pressure—how its regulations either foster or hinder this technological adoption—will be a primary determinant of its long-term role in the high-value biopharmaceutical market.

What Is the Economic Calculus of Reshoring Peptide Production?

The concept of “reshoring” or diversifying the pharmaceutical supply chain away from China is frequently discussed as a strategic imperative for national security and public health. However, the economic and logistical realities of such an undertaking are formidable, especially for peptide production. The cost advantage of Chinese manufacturing is significant, often estimated to be 35-40% lower than in Western countries. This differential is a product of lower labor costs, extensive government subsidies, and less stringent environmental regulations in the past, although this last point is changing.

Replicating this industrial ecosystem elsewhere involves more than just building new factories. It requires cultivating a skilled workforce, navigating complex environmental and zoning laws, and making massive capital expenditures. The table below provides a comparative analysis of the key factors involved in peptide API manufacturing in China versus a potential new facility in the United States or European Union. This analysis illuminates the profound economic friction that inhibits rapid supply chain diversification.

| Factor | Established Chinese Manufacturer | New U.S. / E.U. Facility |

|---|---|---|

| Capital Expenditure (CAPEX) |

Existing infrastructure, often built with state support. Expansion is incremental and benefits from established supply lines for construction and equipment. |

Extremely high initial costs for land acquisition, construction, and specialized equipment (e.g. large-scale solid-phase peptide synthesizers, industrial chromatographs). |

| Regulatory & Environmental Compliance |

Navigates a single, albeit evolving, domestic regulatory system (NMPA). Environmental compliance costs are rising but start from a lower historical baseline. |

Requires lengthy and complex approvals from FDA/EMA, EPA, and local authorities. Environmental impact assessments can delay projects for years. Costs are substantial. |

| Operating Expenses (OPEX) |

Lower labor costs for both skilled and unskilled workers. Lower cost for raw materials and chemical solvents sourced domestically. |

Significantly higher labor, energy, and waste disposal costs. Many chemical precursors may still need to be imported, potentially from China. |

| Time to Market |

Rapid. Existing facilities can scale up production of a new peptide relatively quickly. WuXi AppTec tripled its capacity in a short period. |

Slow. A new facility can take 5-10 years from planning to full GMP-validated production. This timeline is incompatible with addressing immediate drug shortages. |

| Geopolitical Risk Profile |

High concentration risk. Vulnerable to export controls, tariffs, domestic political instability, or the nationalization of supply during a crisis. |

Low concentration risk. Provides supply chain security and resilience for the domestic market. Insulated from foreign trade disputes. |

A secure supply chain for therapeutic peptides is a matter of both national security and public health.

Innovation, Geopolitics, and the Future Market Structure

The long-term implications of China’s regulations will likely create a more fragmented and technologically stratified global peptide market. We may see the emergence of a two-tiered system. The top tier will consist of highly regulated, GMP-compliant peptides, produced in facilities (whether in China, the U.S. or Europe) that have made the necessary investments in advanced quality control.

These products will be expensive, but they will meet the stringent requirements for approved pharmaceutical use. The availability of these high-grade peptides will be directly influenced by both Chinese export policies and Western import strategies, such as the U.S. consideration of export controls on the synthesis technology itself.

Simultaneously, a second, lower-tier market for “research use only” peptides is likely to persist and perhaps grow, especially if the cost of GMP-grade peptides rises significantly. This market operates in a regulatory gray area, and its products do not carry the same assurances of purity or safety. A Chinese regulatory crackdown on the export of non-GMP chemical compounds could disrupt this market severely, or it could drive production to other, less-regulated jurisdictions. This bifurcation presents a challenge for innovation.

While cutting-edge clinical research requires the highest purity compounds, a constrained supply of affordable research-grade peptides could slow the pace of early-stage discovery that fuels the development of future therapies. The ultimate trajectory depends on whether global regulatory frameworks and industrial strategies can successfully balance the goals of safety, affordability, and supply chain resilience.

References

- U.S. Congress, Congressional Research Service. COVID-19 ∞ China Medical Supply Chains and Broader Trade Issues. R46304, 2020.

- Teva Pharmaceutical Industries. “Challenges in the Changing Peptide Regulatory Landscape.” TAPI, 28 Nov. 2022.

- Gautam, A. and L. Macha. “A Bilateral Approach to Address Vulnerability in the Pharmaceutical Supply Chain.” Center for Strategic & International Studies (CSIS), 18 Nov. 2024.

- Mordor Intelligence. “China Active Pharmaceutical Ingredients (API) Market Size & Share Analysis.” Mordor Intelligence, 2024.

- DrugPatentWatch. “The Role of China in the Global Generic Drug API Market.” DrugPatentWatch, 2024.

- Source One. “The Impact of China’s Environmental Regulations on Manufacturing.” Source One, a Corcentric Company.

- ZMUni Compliance Centre. “Unlocking Opportunities in China’s Booming Peptide Market ∞ Key Insights and Compliance Pathways.” ZMUni, 11 Oct. 2024.

- HKTDC Research. “U.S. Export Controls Proposed for Peptide Synthesisers.” HKTDC, 25 Apr. 2023.

- ChemAnalyst. “China’s API Dominance Reshapes Global Pharmaceutical Supply Chains.” ChemAnalyst, 4 Dec. 2024.

- WuXi AppTec. “WuXi STA Opens New Peptide API Manufacturing Plant in Taixing.” Press Release, 10 Jan. 2024.

Reflection

Your Body as a System

The information presented here connects global trade policies and industrial manufacturing to the most personal of concerns ∞ your own health and vitality. The journey to reclaim your biological function is deeply individual, yet it is influenced by a vast, interconnected global system. The science of peptide therapies provides a powerful toolkit for targeted intervention, allowing for the precise recalibration of the body’s communication networks. Understanding the origins of these tools, the pressures that shape their quality, and the forces that govern their availability adds another layer to your knowledge.

This awareness does not complicate the path forward; it clarifies it. It underscores the importance of working with clinical partners who prioritize quality, who understand the nuances of the global supply chain, and who can navigate this complex landscape to source the purest and most effective therapies. Your body is a dynamic system, and your health protocol should be just as dynamic, adapting not only to your internal biological feedback but also to the external realities of the world we live in.

The ultimate goal remains the same ∞ to provide your body with the precise inputs it needs to function with renewed energy and purpose. This knowledge is a step toward making truly informed decisions on that path.