Fundamentals

Experiencing a shift in your vitality, a subtle yet persistent decline in energy, or a recalibration of your internal rhythms can feel isolating. Many individuals grapple with these changes, often attributing them to the inevitable march of time or daily stressors.

However, these sensations frequently signal deeper physiological shifts, particularly within the intricate endocrine system that orchestrates our hormonal and metabolic balance. Understanding the financial mechanisms that can support your journey toward optimal health becomes a critical step in reclaiming your well-being.

When considering investments in personalized wellness, particularly advanced hormonal and metabolic protocols, two distinct financial avenues frequently arise ∞ tax credits and grant programs. These mechanisms, while both offering monetary relief, operate through fundamentally different pathways, each with unique implications for your health journey. A clear comprehension of these distinctions empowers you to make informed decisions about funding your pursuit of renewed function and vitality.

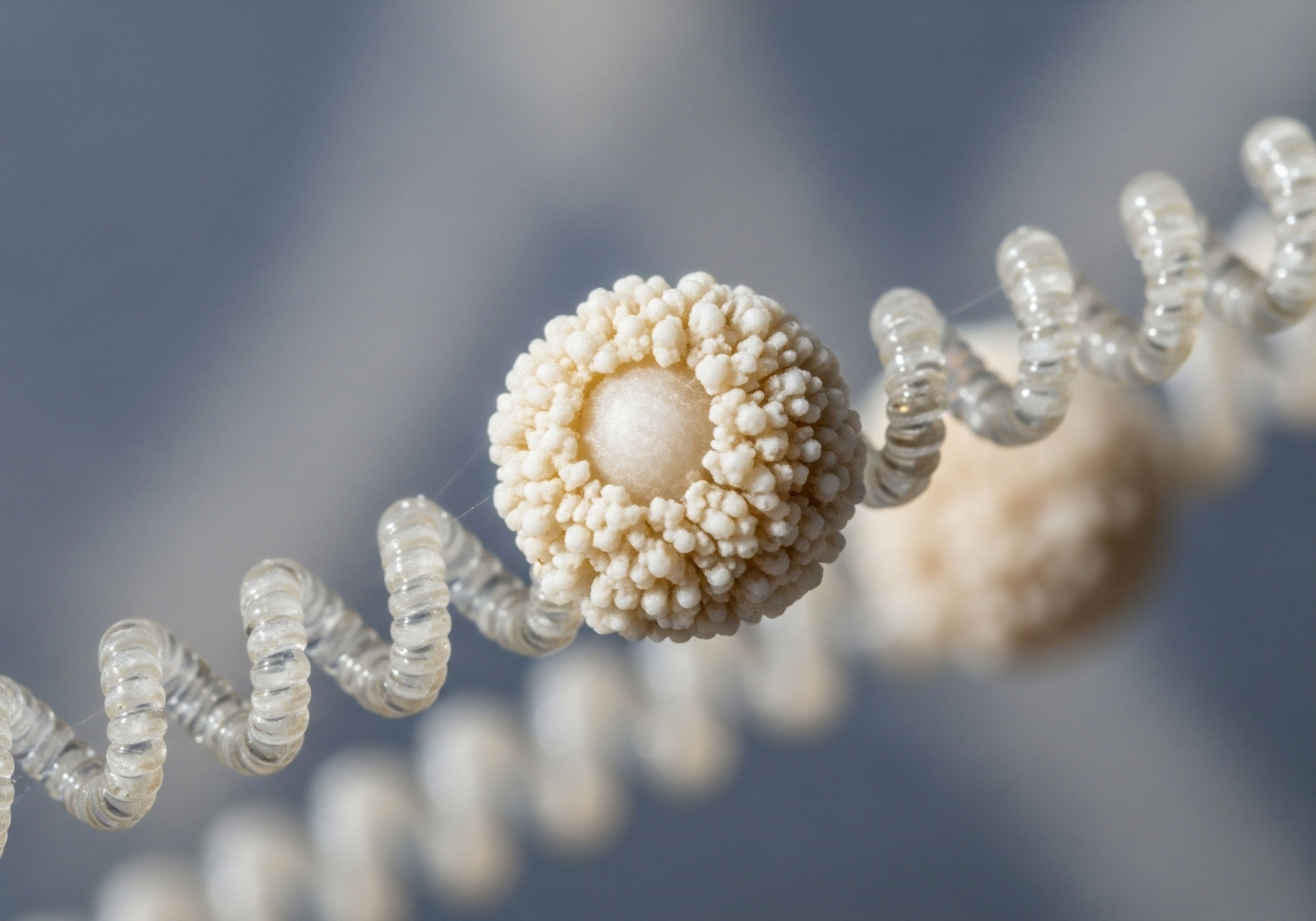

Understanding financial incentives is a crucial first step in accessing personalized wellness protocols and reclaiming one’s vitality.

How Financial Incentives Bolster Wellness Initiatives

Individuals often encounter financial barriers when seeking specialized health interventions. The promise of personalized medicine, with its tailored protocols and advanced diagnostics, frequently comes with a commensurate cost. Financial incentives serve as a vital bridge, enabling access to the precise care needed for individual biological optimization. These programs recognize the long-term societal and individual benefits derived from a healthier, more engaged populace.

The support provided by these programs extends beyond mere cost reduction; it signifies an acknowledgment of the value inherent in proactive health management. Investing in one’s endocrine health, for example, can mitigate the progression of chronic conditions, enhance cognitive function, and improve overall quality of life. This upstream approach to health yields dividends far beyond the initial financial outlay.

Understanding Tax Credits for Health Expenses

A tax credit represents a direct reduction in the amount of tax an individual or entity owes. When you qualify for a health-related tax credit, that amount is subtracted directly from your tax liability. This mechanism effectively reduces the final tax bill, providing financial relief after the fact. The benefit of a tax credit materializes during the tax filing process, requiring individuals to incur the expense first and then claim the credit against their owed taxes.

Consider the scenario where an individual invests in comprehensive metabolic panels or specialized hormonal assays. These diagnostic tools, while essential for establishing a baseline and guiding personalized protocols, can carry substantial upfront costs. A tax credit could help offset these expenses, making advanced diagnostics more accessible by lessening the overall financial burden at tax time.

Exploring Grant Programs for Wellness Support

A grant program provides direct financial disbursements to individuals or organizations for specific purposes, without the expectation of repayment. Grants typically originate from governmental bodies, non-profit foundations, or private organizations. These funds are often awarded based on specific criteria, such as income level, particular health conditions, or participation in designated wellness initiatives. The financial assistance from a grant arrives as an upfront payment, directly supporting the immediate costs of wellness programs or therapies.

An individual seeking to initiate a Testosterone Replacement Therapy (TRT) protocol, for example, might find a grant program beneficial. Such a program could cover the initial consultation fees, the cost of the prescribed medication, or even a portion of ongoing treatment expenses, providing immediate financial relief that facilitates the commencement of therapy.

Intermediate

As individuals progress in their understanding of personal biological systems, the application of targeted wellness protocols becomes increasingly sophisticated. Navigating the landscape of hormonal optimization and metabolic recalibration requires consistent investment, both in terms of time and resources. The choice between leveraging a tax credit or securing a grant program hinges on a nuanced understanding of their operational mechanics and how they align with the ongoing demands of personalized health interventions.

The financial implications extend beyond initial access, influencing the sustainability and comprehensiveness of one’s wellness journey. Optimal endocrine function often necessitates a multi-modal approach, integrating specific therapeutic agents, advanced diagnostics, and lifestyle modifications. Each financial tool presents a distinct pathway for supporting these integrated strategies.

The choice of financial incentive impacts the sustainability and scope of personalized health interventions.

How Do Wellness Incentives Impact Access to Advanced Endocrine Care?

The primary distinction between a tax credit and a grant program lies in the timing and nature of the financial benefit. A tax credit functions as a retrospective reimbursement, reducing an individual’s tax liability after the wellness expenditure has occurred. A grant program, conversely, offers prospective funding, providing capital before or during the wellness intervention. This temporal difference significantly shapes an individual’s ability to initiate or sustain complex protocols.

Consider an individual contemplating Growth Hormone Peptide Therapy, involving agents like Sermorelin or Ipamorelin/CJC-1295. These therapies, designed to support anti-aging, muscle gain, or fat loss, represent a significant financial commitment. A tax credit might offer relief at the end of the fiscal year, assuming the individual has sufficient tax liability. A grant, however, could provide the necessary funds upfront, directly enabling the purchase of peptides and administration supplies, thereby removing an immediate financial barrier.

The directness of the financial transfer is another key differentiator. Grants are typically direct monetary awards, often disbursed specifically for health-related services or products. Tax credits, on the other hand, are an adjustment to tax obligations, requiring the individual to have paid taxes against which the credit can be applied. This means a person with minimal tax liability might find less practical benefit from a tax credit compared to a direct grant.

Comparing Application and Eligibility

Eligibility criteria and application processes also diverge considerably between these two incentive types. Tax credits generally possess broader applicability, often tied to general health expenses that meet specific governmental guidelines. Documentation of expenses, such as receipts for laboratory tests, physician consultations, or prescribed medications, forms the basis of a tax credit claim.

Grant programs, by contrast, typically involve more specific eligibility requirements and a competitive application process. Applicants might need to demonstrate financial need, meet certain health criteria, or propose a wellness plan aligning with the grant’s objectives. For instance, a grant might specifically target individuals with diagnosed hypogonadism seeking Testosterone Replacement Therapy (TRT), requiring detailed medical documentation and a treatment plan.

This table outlines key differences in how tax credits and grants operate within the context of wellness funding ∞

| Aspect of Funding | Tax Credit | Grant Program |

|---|---|---|

| Timing of Benefit | Retrospective (reduces tax liability after expense) | Prospective (direct funds before or during expense) |

| Nature of Benefit | Reduction in taxes owed | Direct financial disbursement |

| Application Complexity | Generally simpler, part of tax filing | Often more complex, competitive application |

| Eligibility Focus | Broad, tied to general health expenses | Specific, tied to particular conditions or demographics |

| Immediate Cash Flow | Does not provide immediate cash | Provides immediate cash |

Optimizing Endocrine Support through Financial Planning

For individuals committed to a comprehensive personalized wellness protocol, understanding the interplay of these financial tools becomes a strategic advantage. An individual managing peri-menopausal symptoms with low-dose Testosterone Cypionate and Progesterone might strategically utilize a tax credit for recurring medication costs and specialist visits. Simultaneously, they might seek a grant to cover a more intensive initial diagnostic phase or a specialized peptide protocol like PT-141 for sexual health.

The decision rests upon an individual’s financial situation, immediate cash flow needs, and the specific nature of the wellness intervention. Individuals with substantial tax liabilities may find tax credits significantly reduce their overall financial burden. Individuals with limited upfront capital or those seeking funding for highly specialized, often out-of-pocket, therapies might find grants indispensable.

Academic

The discourse surrounding wellness incentives transcends simplistic definitions, extending into the complex interplay of health economics, public health policy, and the nuanced realities of individual biological optimization. When examining the structural distinctions between tax credits and grant programs, a deeper analytical framework reveals how these mechanisms influence the accessibility and sustainability of advanced endocrine and metabolic interventions, thereby shaping population health outcomes. This analysis necessitates a multi-method integration, considering both microeconomic incentives and macroeconomic impacts.

The effectiveness of any financial incentive for wellness must be evaluated against its capacity to facilitate adherence to complex, long-term protocols. For instance, the consistent administration of Gonadorelin to maintain natural testosterone production in men undergoing TRT, or the precise titration of Anastrozole to manage estrogen conversion, demands uninterrupted access to medication and monitoring. The financial architecture supporting these needs plays a pivotal role in clinical success.

Financial incentive structures directly influence adherence to complex, long-term endocrine protocols, impacting clinical success.

How Do Incentive Structures Influence Long-Term Health Equity?

A hierarchical analysis of financial incentives begins with their direct impact on individual behavior and progresses to their broader societal implications. Tax credits, by their nature, disproportionately benefit those with higher taxable incomes, as the value of the credit directly offsets a larger tax burden.

This inherent characteristic suggests a potential for exacerbating health disparities, as individuals with lower incomes and thus lower tax liabilities may receive a diminished effective benefit, even if their need for wellness support is equally pronounced.

Grant programs, conversely, possess the structural flexibility to target specific populations or health conditions, potentially mitigating existing inequities. Philanthropic foundations or government initiatives can design grants to specifically support underserved communities or individuals struggling with chronic metabolic dysfunction, ensuring that financial barriers do not impede access to essential care. This distinction is particularly salient in the context of personalized medicine, where the costs of genetic testing, advanced biomarker analysis, and compounded therapeutic peptides can be prohibitive for many.

Analyzing the Economic Pathways of Wellness Funding

The economic pathways through which tax credits and grants influence wellness engagement present distinct advantages and limitations. Tax credits stimulate demand for wellness services by reducing the net cost to the consumer. This indirect subsidy encourages individuals to seek out and pay for services, thereby supporting the private wellness market. The government foregoes tax revenue, effectively subsidizing consumer choice. This model, while promoting market activity, relies on individuals having the initial capital to cover the expense.

Grant programs operate as a direct supply-side or demand-side intervention. A grant to a clinic offering peptide therapy, such as Pentadeca Arginate (PDA) for tissue repair, represents a supply-side subsidy, allowing the clinic to offer services at a reduced cost or even free of charge to eligible patients.

A grant directly to an individual to cover the cost of a comprehensive metabolic reset program represents a demand-side subsidy, directly empowering the individual’s purchasing power. This directness can circumvent the initial capital requirement that often poses a barrier for tax credit utilization.

This comparative analysis reveals the distinct economic and social outcomes associated with each funding mechanism ∞

| Economic Factor | Tax Credit Impact | Grant Program Impact |

|---|---|---|

| Market Stimulation | Indirect, consumer-driven demand | Direct, supply-side or demand-side intervention |

| Equity Considerations | Potential for regressive impact on lower incomes | Capacity for targeted, progressive support |

| Administrative Burden | Lower for government (part of existing tax system) | Higher for government/grantors (program design, oversight) |

| Innovation Support | Encourages market-driven innovation | Can direct innovation towards specific public health goals |

Evaluating the Efficacy of Incentives in Metabolic Recalibration

From a clinical perspective, the efficacy of wellness incentives rests on their ability to facilitate sustained behavioral change and adherence to medical protocols. The physiological recalibration of the endocrine system, whether through hormonal optimization protocols for menopausal women or growth hormone peptide regimens for sarcopenia, demands consistency. Intermittent access due to financial constraints undermines therapeutic outcomes.

For instance, a patient initiating a complex peptide regimen like Tesamorelin for visceral fat reduction or Hexarelin for growth hormone release requires uninterrupted access to these agents. A grant that covers a six-month supply provides a stable foundation for treatment, promoting adherence.

A tax credit, while reducing the annual financial burden, may not address the month-to-month cash flow challenges that could disrupt treatment. The long-term economic benefits of such interventions, including reduced incidence of metabolic syndrome or improved cardiovascular markers, underscore the importance of stable funding mechanisms.

Stable funding for personalized medicine protocols supports consistent adherence, which is vital for achieving optimal therapeutic outcomes and long-term health benefits.

The selection of an appropriate incentive structure requires a thorough understanding of its downstream effects on patient access, treatment adherence, and overall health equity. Policymakers and healthcare providers must consider the specific needs of the target population and the nature of the wellness interventions being supported.

A balanced approach, integrating both broad-based tax incentives and targeted grant programs, may represent the most comprehensive strategy for fostering a society where optimal metabolic and hormonal health is an attainable reality for all.

References

- Baicker, K. Cutler, D. & Song, Z. (2010). Workplace wellness programs can generate savings. Health Affairs, 29(2), 304-311.

- Hlatky, M. A. et al. (2018). Impact of hormone therapy on Medicare spending in the Women’s Health Initiative randomized clinical trials. American Heart Journal, 199, 131-137.

- Horwitz, J. R. B. Kelly, B. J. & DiNardo, J. E. (2013). The Impact of Financial Incentives on Health and Healthcare ∞ Evidence from a Large Wellness Program. Stanford University.

- Maltby, L. (2008). Employer health incentives. Harvard T.H. Chan School of Public Health.

- Mattke, S. Schnyer, C. & Van Busum, K. R. (2013). Workplace Wellness Programs Study ∞ Final Report. RAND Corporation.

- Mukherjee, S. (2010). The Emperor of All Maladies ∞ A Biography of Cancer. Scribner.

- Porter, J. E. (2014). Peptide-based Drug Research and Development ∞ Relative Costs, Comparative Value. Journal of Peptide Science, 20(5), 317-325.

- Rajan, S. S. & Kumar, V. (2022). Therapeutic peptides ∞ current applications and future directions. Journal of Peptide Science, 28(2), e24231.

- Sacks, O. (1985). The Man Who Mistook His Wife for a Hat and Other Clinical Tales. Summit Books.

- Schwartz, M. W. & Cummings, D. E. (2013). Fetal programming of adult obesity ∞ a role for leptin in mediating the effect of maternal undernutrition? Trends in Endocrinology & Metabolism, 24(10), 504-510.

- Teles, D. (2018). Exploring the Potential of Tax Credits for Funding Population Health. National Academy of Medicine.

- Volpp, K. G. et al. (2011). Financial incentives for health behavior change. The New England Journal of Medicine, 365(18), 1729-1731.

Reflection

This exploration of financial incentives, viewed through the lens of your unique biological blueprint, represents more than an academic exercise. It offers a framework for personal empowerment. Understanding how tax credits and grant programs operate equips you with the strategic insight to navigate the complexities of modern healthcare, particularly when pursuing advanced wellness protocols.

Your journey toward reclaiming vitality is deeply personal, and the knowledge of these financial pathways can serve as a potent catalyst, transforming aspiration into tangible action. Consider this understanding a foundational element in your ongoing commitment to self-optimization, recognizing that informed choices about funding your health are as critical as the clinical protocols themselves.