Fundamentals

You may be tracking your health with a focus on optimizing hormone levels, perhaps through testosterone replacement therapy Meaning ∞ Testosterone Replacement Therapy (TRT) is a medical treatment for individuals with clinical hypogonadism. or by using specific peptides to enhance physical function and recovery. Amidst this journey of biochemical recalibration, a significant development in the broader landscape of metabolic health is occurring, one with deep personal implications. The impending patent expiration of Semaglutide in China is an event that will reshape the accessibility of a powerful tool for metabolic control.

This change is directly relevant to your goals, because foundational metabolic health Meaning ∞ Metabolic Health signifies the optimal functioning of physiological processes responsible for energy production, utilization, and storage within the body. is the platform upon which hormonal balance is built. An inefficient metabolic system, characterized by insulin resistance, can disrupt the delicate signaling of the entire endocrine network, including the very hormones you are working to optimize.

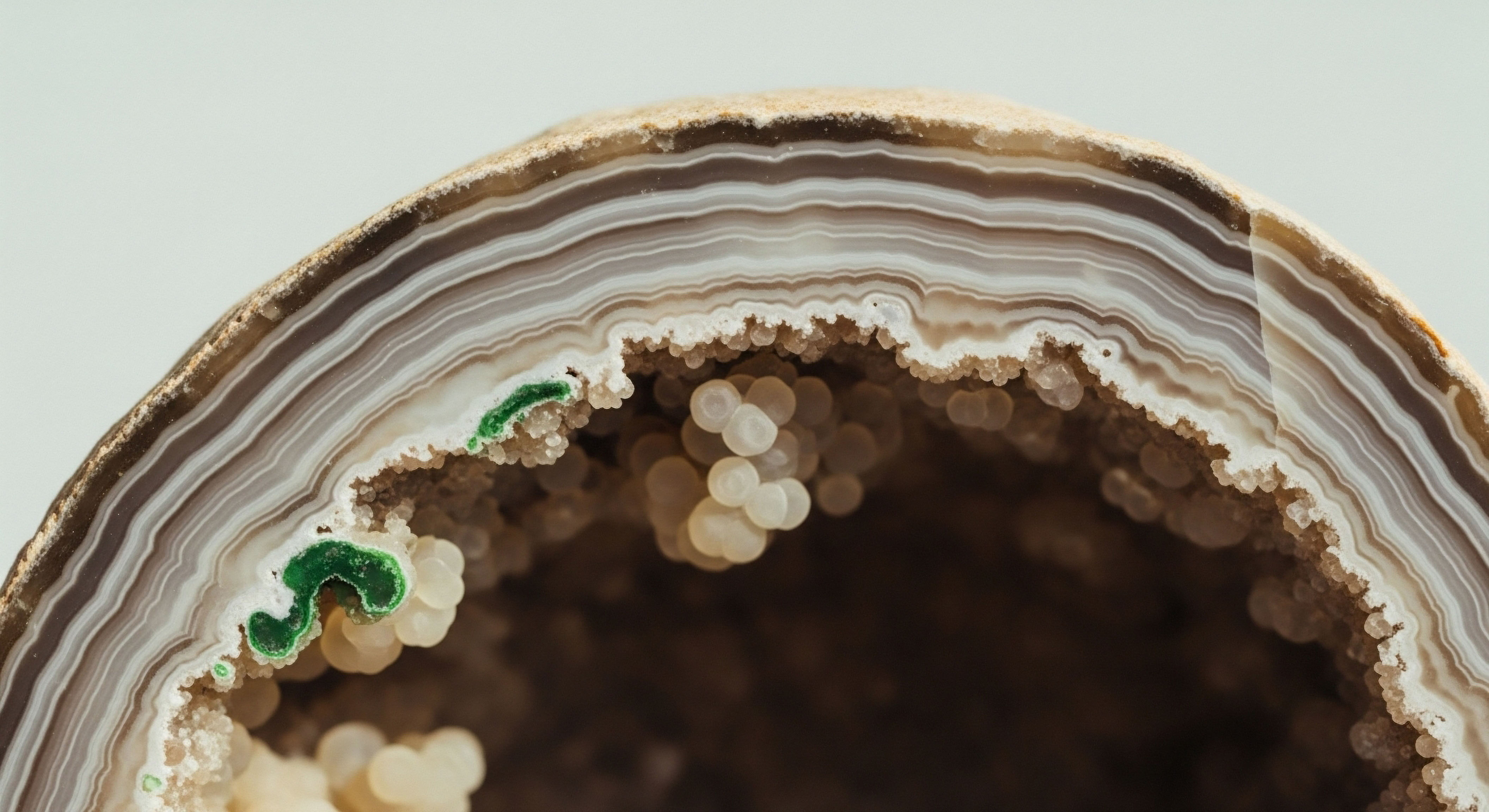

Understanding this connection begins with recognizing how your body manages energy. Every meal initiates a complex cascade of hormonal signals designed to process and store nutrients. A key messenger in this system is a hormone called glucagon-like peptide-1 (GLP-1). Secreted by cells in your intestine after you eat, GLP-1 communicates with your pancreas to release insulin, which helps your cells absorb glucose from the bloodstream for energy.

It also sends signals to your brain to create a sense of satiety, and it slows the rate at which your stomach empties, preventing sharp spikes in blood sugar. This intricate biological feedback loop is designed to maintain metabolic equilibrium. However, factors like genetics, diet, and lifestyle can lead to a state of insulin resistance, where your cells become less responsive to insulin’s signal. This forces the pancreas to work harder, disrupting the entire metabolic and hormonal orchestra.

The Role of Semaglutide in Metabolic Regulation

Semaglutide is a synthetic version of the GLP-1 hormone, engineered to be more resilient and longer-lasting than the body’s naturally produced version. Its function is to mimic and amplify the actions of native GLP-1, effectively restoring a powerful degree of metabolic control. By activating GLP-1 receptors, it enhances glucose-dependent insulin secretion, suppresses the release of glucagon (a hormone that raises blood sugar), slows gastric emptying, and directly acts on the brain’s appetite centers. This process helps to recalibrate the body’s response to food and energy, addressing the root mechanisms of metabolic dysfunction.

The expiration of Semaglutide’s patent in China signals a shift toward greater accessibility of a key tool for managing the body’s fundamental energy and hormonal systems.

The economic implications of this patent expiration are substantial. Currently, Novo Nordisk, the Danish pharmaceutical company that developed Semaglutide (marketed as Ozempic and Wegovy), holds a dominant position in the Chinese market for GLP-1 agents. The patent’s expiration in 2026 will open the door for numerous Chinese pharmaceutical companies to produce and market generic versions of the medication.

At least 15 generic versions are already in development, with several in late-stage clinical trials. This influx of competition is expected to have a profound effect on the cost of the medication, making it available to a much wider population.

Why Does Broader Access Matter for Your Health Journey?

The connection back to your personal wellness protocol is direct. Chronic metabolic dysregulation, particularly insulin resistance, is a significant stressor on the body. It can elevate inflammatory markers and disrupt the Hypothalamic-Pituitary-Gonadal (HPG) axis, the central command system that governs testosterone production in men and estrogen/progesterone cycles in women.

When the body is constantly managing blood sugar crises, its ability to maintain optimal hormonal balance can be compromised. Symptoms of low testosterone or perimenopausal hormonal fluctuations can be exacerbated by underlying metabolic issues.

Therefore, the increased availability of a potent metabolic regulator like Semaglutide represents more than just a market event. It signifies an opportunity for millions to address a foundational piece of their health puzzle. By improving insulin sensitivity and restoring metabolic balance, individuals can create a more stable internal environment.

This stability can enhance the effectiveness of other targeted therapies, from TRT to growth hormone peptides, allowing those protocols to function optimally without fighting against a backdrop of metabolic chaos. The economic shift in China is poised to democratize access to this level of metabolic control, with far-reaching consequences for individual and public health.

Intermediate

The expiration of Novo Nordisk’s core patent for Semaglutide in China in 2026 is a watershed moment for the pharmaceutical industry and public health. This event transitions the conversation from the molecule’s clinical efficacy to the complex economic and logistical realities of its widespread distribution. For the individual engaged in a personalized wellness protocol, understanding these dynamics is key to anticipating how the landscape of available therapeutic tools will evolve. The shift from a single-source, high-cost medication to a competitive market of generic biosimilars will have cascading effects on pricing, access, and even the standard of care for metabolic disease in China and potentially beyond.

What Are the Market Dynamics before Patent Expiration?

Prior to 2026, Novo Nordisk enjoys a near-monopoly on the Semaglutide market in China, a country facing a significant and growing public health Meaning ∞ Public health focuses on the collective well-being of populations, extending beyond individual patient care to address health determinants at community and societal levels. challenge related to metabolic disease. China has the largest population of individuals with diabetes in the world, with prevalence rates among adults rising dramatically over the past few decades. This creates immense demand for effective treatments like GLP-1 receptor Meaning ∞ The GLP-1 Receptor is a crucial cell surface protein that specifically binds to glucagon-like peptide-1, a hormone primarily released from intestinal L-cells. agonists. Novo Nordisk’s Ozempic was approved in China in 2021 for type 2 diabetes, and its sales have grown exponentially since.

This market dominance allows the company to set premium pricing, limiting access primarily to those who can afford it out-of-pocket or have robust insurance coverage. The high cost is a direct barrier to the millions who could benefit from its metabolic-regulating effects.

The Economic Transformation Post-2026

The patent cliff will trigger a rapid and aggressive entry of domestic competitors. More than a dozen Chinese pharmaceutical companies are in the final stages of developing their own Semaglutide biosimilars. This impending competition is the primary driver of the anticipated economic changes:

- Price Reduction ∞ Analysts predict that the introduction of generic competitors could lead to significant price drops for Semaglutide in China. This reduction makes the therapy accessible to a much broader segment of the population, shifting it from a niche drug to a potential cornerstone of public health strategy.

- Market Share Dilution ∞ Novo Nordisk’s commanding market share will inevitably be diluted. While the overall market for GLP-1 agents is expected to grow, the Danish company will have to compete with local manufacturers on price and distribution. Some analysts project that Chinese players could capture a substantial portion of the market.

- Manufacturing and Supply Chain ∞ The challenge for new entrants will be scaling production. Manufacturing complex biologics like Semaglutide and packaging them in precise injector pens is technically demanding. The ability to produce high-quality, stable biosimilars at scale will be a determining factor in which companies succeed. Novo Nordisk itself is investing heavily in its Chinese production facilities to meet demand, indicating the scale of the opportunity.

The transition from a patented monopoly to a competitive generic market is poised to dramatically lower the cost of Semaglutide, fundamentally altering its role in China’s healthcare system.

The following table illustrates the anticipated shifts in the Chinese Semaglutide market, providing a clear comparison of the pre- and post-patent expiration environments.

| Market Factor | Pre-2026 (Patent Protected) | Post-2026 (Generic Competition) |

|---|---|---|

| Primary Supplier | Novo Nordisk | Multiple domestic Chinese manufacturers + Novo Nordisk |

| Pricing Structure | Premium, set by patent holder | Competitive, driven by market forces and government negotiations |

| Patient Access | Limited by high cost and insurance coverage | Broadened significantly due to lower prices |

| Market Share | Dominated by Novo Nordisk (approx. 70% of GLP-1 market) | Diluted, with domestic firms potentially capturing a large share |

| Role in Healthcare | Specialized treatment for diabetes and off-label weight management | Potential for widespread use in national public health initiatives for diabetes and obesity |

How Will This Affect Clinical Protocols and Personalized Health?

For those utilizing advanced wellness strategies like hormonal optimization or peptide therapies, this economic shift has several important implications. The wider availability of an effective agent for managing insulin resistance Meaning ∞ Insulin resistance describes a physiological state where target cells, primarily in muscle, fat, and liver, respond poorly to insulin. and obesity could establish a new baseline for metabolic health. Clinicians may increasingly see Semaglutide or its biosimilars as a foundational intervention to address metabolic dysfunction before or alongside other treatments. For example, optimizing a patient’s metabolic health with a GLP-1 agonist could improve the efficacy and safety of Testosterone Replacement Therapy (TRT).

Improved insulin sensitivity can lower levels of Sex Hormone-Binding Globulin (SHBG), increasing the amount of free, bioavailable testosterone. Similarly, by reducing systemic inflammation associated with obesity, it creates a more favorable environment for therapies aimed at tissue repair and recovery, such as the peptide PT-141 or Sermorelin.

The patent expiration is a catalyst for a new era in metabolic management, where powerful tools become commodities, and the focus of personalized medicine can shift to integrating these tools into a holistic, systems-based approach to health.

Academic

The expiration of Semaglutide’s composition of matter patent in China in 2026 represents a critical inflection point with far-reaching economic and public health consequences. An academic analysis of this event moves beyond market share forecasts to examine the deeper systemic impacts, including the influence on China’s domestic biopharmaceutical industry, the potential for reverse innovation, and the complex interplay between widespread GLP-1 receptor agonist Meaning ∞ GLP-1 Receptor Agonists are pharmaceutical agents mimicking glucagon-like peptide-1, a natural incretin hormone. availability and the broader endocrine health of the population. The central thesis is that the commoditization of Semaglutide will not only reshape the therapeutic landscape for metabolic disease but will also serve as a powerful catalyst for China’s ambitions in advanced biologic manufacturing and global pharmaceutical competition.

The Strategic Importance of GLP-1 Biosimilars for China

China is confronting a public health crisis of staggering proportions, with an estimated 147 million adults living with diabetes and prevalence rates that have surged in recent decades. The economic burden of managing diabetes and its comorbidities, such as cardiovascular and renal disease, is immense. In this context, the domestic production of Semaglutide biosimilars is a strategic imperative.

The government’s “Healthy China 2030” initiative prioritizes the prevention and control of major chronic diseases, creating a policy tailwind for affordable and effective treatments. The patent expiration provides a legal gateway for Chinese firms to address this massive domestic need, reducing reliance on imported pharmaceuticals and aligning with national industrial policy goals aimed at building a world-class biopharmaceutical sector.

The race to market is intense, with firms like Hangzhou Jiuyuan Gene Engineering and CSPC Pharmaceutical Group leading a pack of over a dozen contenders. Success will depend on navigating three key challenges:

- Bioequivalence Demonstration ∞ Competitors must conduct rigorous clinical trials to prove their biosimilar has comparable efficacy and safety to Novo Nordisk’s reference product, Ozempic. This requires substantial investment in R&D and clinical operations.

- Manufacturing Scalability and Quality Control ∞ The synthesis of a complex peptide like Semaglutide and its formulation into a reliable autoinjector device is a significant technical hurdle. Mastering this process at a scale sufficient to supply a meaningful portion of the Chinese market is a primary determinant of success.

- Navigating Price Controls and Reimbursement ∞ Gaining inclusion in China’s National Reimbursement Drug List (NRDL) is critical for market penetration. This involves intense price negotiations with the government, which will leverage the competitive landscape to drive down costs dramatically.

What Is the Potential for Global Market Disruption?

While the immediate impact is domestic, the development of a robust Semaglutide manufacturing ecosystem in China has global implications. Chinese firms that successfully develop and scale high-quality biosimilars will not be content to serve only their home market. They will likely seek to export their products to other regions where patents have expired or were never filed, particularly in developing nations across Asia, Africa, and Latin America. This could lead to a global price erosion for GLP-1 agonists, mirroring the effect Chinese manufacturers have had in the market for active pharmaceutical ingredients (APIs) for small-molecule drugs.

The commoditization of Semaglutide in China will likely serve as a springboard for its domestic pharmaceutical industry to compete on a global scale in the advanced biologics arena.

This table outlines the key players and the strategic dimensions of the race for Semaglutide biosimilars in China.

| Competitor Profile | Key Companies | Strategic Focus | Potential Long-Term Impact |

|---|---|---|---|

| Domestic Front-Runners | Hangzhou Jiuyuan Gene Engineering, Huadong Medicine, CSPC Pharmaceutical Group | Achieving bioequivalence, securing domestic market approval, and navigating NRDL price negotiations. | Capture significant domestic market share and establish a foundation for international expansion. |

| Incumbent Innovator | Novo Nordisk | Defending patent validity, expanding manufacturing in China, and potentially competing on price post-expiration. | Maintain a premium brand segment while losing volume share to generics; focus on next-generation therapies. |

| Other Global Players | Eli Lilly (with Tirzepatide) | Introducing next-generation, potentially more effective dual-agonist therapies to compete on clinical superiority. | Create a market segment for higher-priced, more advanced therapies, bifurcating the market. |

Endocrine Systems Biology a Downstream Consequence

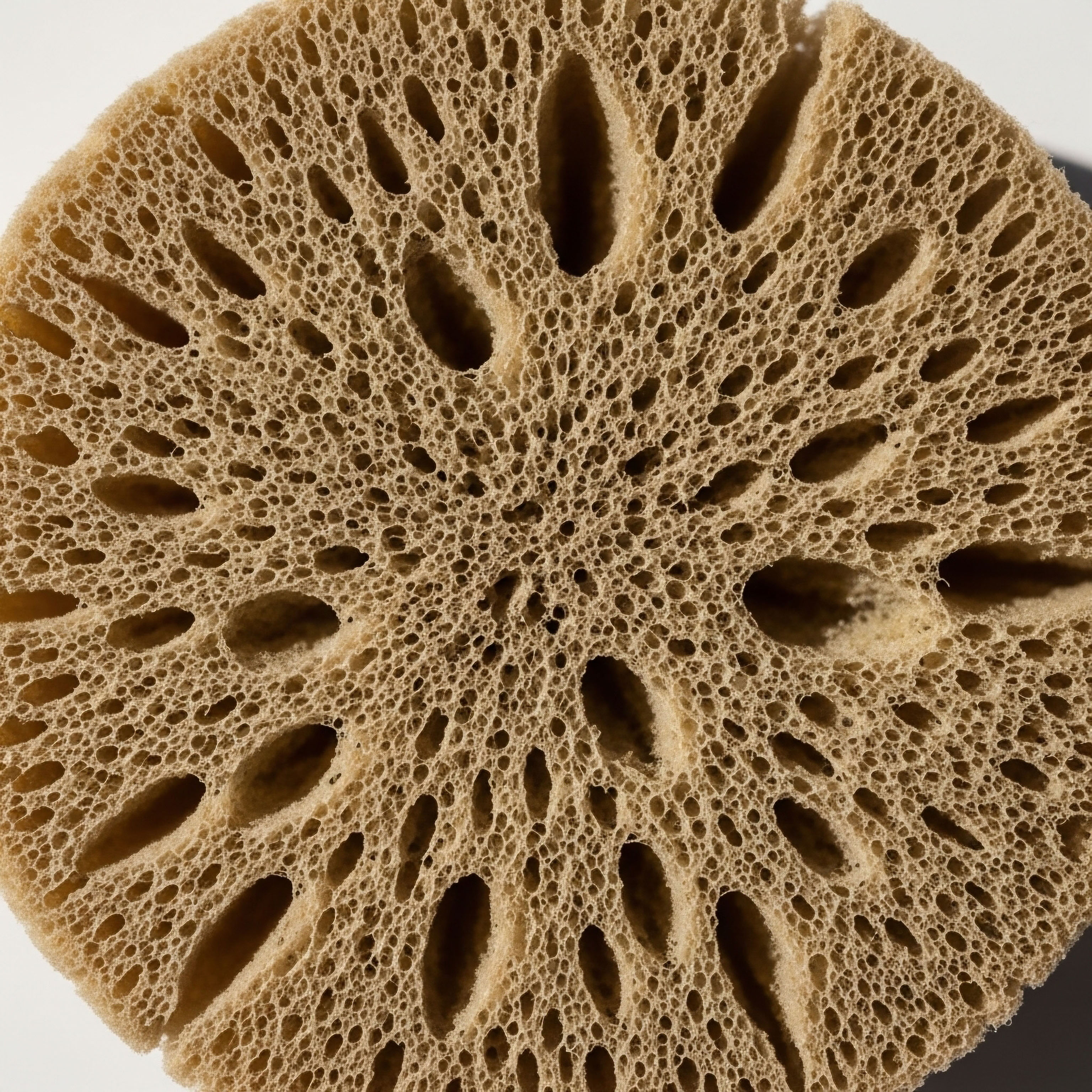

From a systems biology perspective, the widespread use of a potent metabolic modulator like Semaglutide will have population-level effects on endocrine health that extend beyond glycemic control. Chronic hyperinsulinemia and obesity are known to disrupt the entire hormonal milieu. For instance, they are associated with increased aromatase activity, which converts androgens to estrogens, contributing to conditions like hypogonadism in men. They also promote a state of chronic, low-grade inflammation that can impair the function of the Hypothalamic-Pituitary-Adrenal (HPA) axis and the HPG axis.

By making a tool that can effectively combat obesity and insulin resistance widely available, the patent expiration could lead to a population-level improvement in these related endocrine disorders. A metabolically healthier population may see a reduction in the incidence of polycystic ovary syndrome (PCOS) in women and functional hypogonadism in men. This creates a fascinating public health scenario where an economic event—a patent expiration—could have profound, secondary benefits on the overall endocrine and reproductive health of a nation. The data generated from China’s large-scale adoption of Semaglutide will provide an unprecedented opportunity to study these systemic effects outside the confines of a controlled clinical trial.

References

- Buse, John B. et al. “The science of GLP-1 receptor agonists.” HCPLive, 15 Mar. 2019.

- Ng, Eric. “Mainland Chinese market for weight loss and diabetes drugs to soon be more crowded ∞ report.” South China Morning Post, 2 June 2025.

- “Novo’s Ozempic, Wegovy to Face Stiff Generic Competition in China ∞ Reuters.” BioSpace, 6 June 2024.

- “Diabetes in China (2024).” International Diabetes Federation, 2024.

- Che, Jennifer. “How post-filing data rescued Novo Nordisk’s Ozempic patent in China.” Managing IP, 15 Oct. 2024.

- “Novo Nordisk Prepares For Battle In China’s Weight-Loss Drug Market.” Finimize, 2024.

- “The Battle for Billions ∞ Understanding the Ozempic Patent Landscape.” L.E.K. Consulting, 26 Nov. 2024.

- He, et al. “The national and provincial prevalence and non-fatal burdens of diabetes in China from 2005 to 2023 with projections of prevalence to 2050.” Journal of Translational Medicine, vol. 22, no. 1, 2024, p. 531.

- Trujillo, Jennifer M. et al. “A review of GLP-1 receptor agonists in type 2 diabetes ∞ A focus on the mechanism of action of once-weekly agents.” Diabetes & Metabolism, vol. 47, no. 3, 2021, 101212.

- Zhao, Xiaolin, et al. “GLP-1 Receptor Agonists ∞ Beyond Their Pancreatic Effects.” Frontiers in Endocrinology, vol. 12, 2021, p. 721135.

Reflection

The journey to reclaim and optimize your body’s function is deeply personal, built upon understanding your own unique biochemistry. The information presented here, detailing a major economic shift in the pharmaceutical world, is another piece of that complex puzzle. The story of Semaglutide in China is a powerful illustration of how global market forces can directly influence the tools available for your personal health strategy.

It highlights the foundational importance of metabolic health as the bedrock upon which hormonal balance and overall vitality are constructed. As access to powerful therapies evolves, the opportunity to address the root causes of metabolic dysfunction becomes more attainable.

This knowledge equips you to have more informed conversations about your long-term wellness plan. It encourages a perspective that looks beyond immediate symptoms to the underlying systems that govern your health. The path forward involves integrating this understanding into your personal health narrative, recognizing that true optimization comes from addressing the body as an interconnected system. What does achieving foundational metabolic balance mean for your specific goals, and how might these evolving therapeutic landscapes shape your path forward?