Foundational Biology and Program Structure

The persistent sensation of low vitality ∞ that deep, pervasive fatigue that resists simple rest ∞ is not a failure of will; it is often a quantifiable perturbation within your body’s most sophisticated internal communication network, the endocrine system.

We recognize this lived experience of diminished function, perhaps noticing shifts in mood regulation or a metabolic sluggishness that seems resistant to standard adjustments; these subjective states are the somatic echoes of subtle biochemical recalibrations occurring at the cellular level, frequently involving the Hypothalamic-Pituitary-Gonadal (HPG) axis or the HPA (Hypothalamic-Pituitary-Adrenal) axis.

When an organization seeks to address these systemic inefficiencies through a formal wellness structure, the resulting framework must align with regulatory definitions to achieve its intended outcome, which, in this context, is supporting the biological architecture underpinning employee performance.

Understanding how these structures influence tax liability begins with recognizing the Internal Revenue Service’s classification system ∞ is the employer’s contribution categorized as a general incentive, or is it recognized as a payment for ‘medical care’ that affects a structure or function of the body?

Consider the body’s systems as an incredibly complex, self-regulating electrical grid; a simple incentive, like a small gift, is akin to a momentary voltage spike, easily accounted for and taxed as miscellaneous compensation.

Conversely, a program structured to provide targeted support, such as advanced diagnostic testing for sex hormone panels or cortisol rhythm analysis, aims to correct an underlying current imbalance, which aligns more closely with the statutory definition of medical care, thereby shifting its tax treatment for both the organization and the recipient.

The distinction between a taxable reward and a non-taxable health benefit hinges entirely upon the precise structural definition of the employer’s support mechanism.

This initial delineation is paramount because the manner in which an organization structures its wellness offerings ∞ whether as a simple reimbursement mechanism or as a comprehensive, qualifying accident and health plan ∞ determines the resulting fiscal consequence for the employee’s gross income.

When you feel the system is not operating optimally, the structures designed to support it must be precise enough to address the root biological mechanism, which in turn informs the legal structure of the benefit provision.

Intermediate Protocol Structures and Tax Classification

Moving beyond generalities, we observe that supporting complex physiological states, such as managing symptoms associated with peri-menopause or addressing declining androgen levels in men, necessitates specific clinical protocols that demand a more sophisticated wellness structure from an employer.

A program designed to facilitate true endocrine system support ∞ perhaps including access to specialized services like weekly subcutaneous Gonadorelin injections for testicular support during TRT, or the provision of bioidentical Progesterone for female patients ∞ cannot be managed through simple, low-value incentives.

These interventions, because they are aimed at the diagnosis, mitigation, treatment, or prevention of a condition, or specifically affecting a structure or function of the body (as per Section 213(d) medical care definition), are fundamentally different from a general gym membership subsidy.

The structural mechanism an employer utilizes dictates the tax outcome; for instance, payments reimbursed under a nonaccountable plan are generally included in the employee’s wages, regardless of the clinical purpose of the expense.

We must examine the administrative architecture ∞ does the program fall under Section 105/106 exclusions for accident or health plans, or does it operate under Section 125 cafeteria plans, where the tax implications become conditional?

When employees utilize pre-tax salary reductions within a Section 125 plan to pay for a wellness component, the subsequent reimbursement of those contributions often reverts to being taxable income, even if the underlying service was health-related, unless it strictly meets the medical care exclusion criteria.

The following comparison clarifies how the form of the benefit dictates its tax status, which in turn affects the accessibility of advanced physiological support:

| Wellness Program Structure Type | Clinical Intervention Example | Typical Tax Implication for Employee |

|---|---|---|

| De Minimis Fringe Benefit | Company-provided water bottle or T-shirt | Excluded from income (non-taxable) |

| Cash Incentive/Reward | A $50 gift card for achieving a step goal | Included in gross income (taxable) |

| Qualified Medical Care Reimbursement | Employer payment for prescribed Pentadeca Arginate (PDA) for tissue repair | Excluded from income (non-taxable) under Sec. 105/106 |

| Gym Membership Reimbursement | Reimbursement for a standard fitness center fee | Generally included in income (taxable) unless prescribed |

An astute organizational design recognizes that to fund sophisticated interventions, such as those involving low-dose Testosterone Cypionate for women or specialized peptide therapies like Sermorelin for growth hormone support, the structure must aim for the Sec. 213(d) medical care exclusion, otherwise, the benefit becomes a taxable wage component, potentially diminishing its real-world value to the employee.

The challenge lies in creating a structure that acknowledges the necessity of systemic biological recalibration while navigating the established boundaries of tax code exclusions.

- Medical Care Qualification ∞ Benefits must align with the statutory definition of diagnosis, cure, mitigation, treatment, or prevention of disease, or affecting body structure/function.

- Section 125 Plan Use ∞ Salary reduction contributions within a cafeteria plan, when used to fund certain wellness incentives, can complicate the tax-free status of subsequent reimbursements.

- Employer Deductibility ∞ Even when a fringe benefit is taxable to the employee, the employer’s cost for providing that benefit remains generally deductible as a business expense.

This necessitates a deliberate choice in program design ∞ supporting general well-being via non-taxable small items, or structuring support for specific physiological needs so that the benefit qualifies for income exclusion.

Academic Analysis of Endocrine Support and Tax Categorization

The exploration of how specific wellness program structures influence tax liability for employees mandates a deep consideration of the underlying pathophysiology that necessitates the program in the first place, viewing the tax code as a secondary regulatory system responding to primary biological realities.

We proceed by examining the premise that advanced wellness protocols, such as those targeting chronic HPA axis dysregulation often seen in high-stress corporate environments, qualify as medical care, which carries distinct tax advantages under the Internal Revenue Code (IRC).

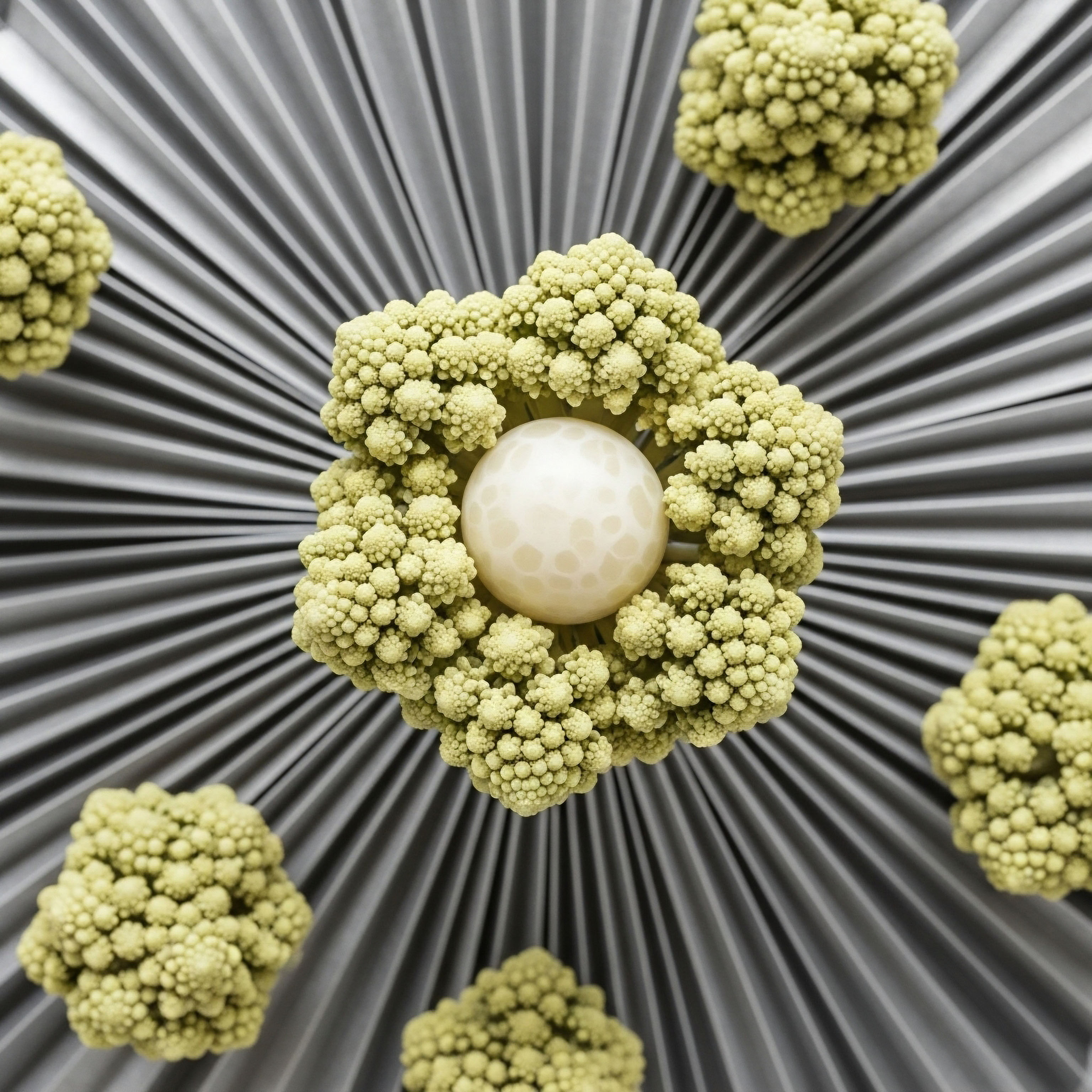

A state of chronic, unmanaged physiological stress drives allostatic load, leading to sustained cortisol elevation, which directly interferes with the Hypothalamic-Pituitary-Gonadal (HPG) axis, resulting in suppressed testosterone and suboptimal metabolic signaling.

A wellness program structured to mitigate this by providing, for instance, clinical guidance on HPA axis normalization, or access to targeted agents like MK-677 for sleep and metabolic improvement, is attempting to treat a functional disorder, not merely promote general fitness.

The critical legal demarcation lies in whether the program payment is deemed an “amount which the taxpayer would be entitled to receive irrespective of whether or not he incurs expenses for medical care”. If the wellness benefit is a fixed payment triggered by participation, independent of an actual incurred medical expense, the IRS is likely to classify it as taxable remuneration.

Conversely, a structure that mandates documentation of an expense that meets the Sec. 213(d) definition ∞ for example, reimbursement for an advanced lipidomic panel or specific nutritional intervention directly supporting endocrine function ∞ is more likely to qualify for exclusion under Sec. 105(b).

This difference in classification profoundly impacts the net value of the benefit to the employee, as taxable income is subject to Federal Income Tax Withholding (FITW), FICA (Social Security/Medicare), and FUTA taxes, whereas qualified medical care reimbursements are not.

The HPG Axis and Definitional Rigor

Consider the specific application of Testosterone Replacement Therapy (TRT) in men experiencing symptomatic androgynous decline, often managed with weekly Testosterone Cypionate injections alongside ancillary agents like Anastrozole to manage aromatization. If an employer covers this protocol directly as a health benefit, the structure must withstand scrutiny as “medical care.”

The rationale for inclusion in the tax base rests on the argument that such interventions are elective optimization rather than mandated disease treatment, yet the clinical reality is that these protocols restore function toward a physiological set-point, a core component of medical treatment.

The tax authority’s assessment hinges on documentation and plan design, a structure that must mirror clinical evidence for efficacy and necessity.

The following schema contrasts the tax treatment based on the specificity of the wellness intervention structure:

| Intervention Specificity | Program Structure Alignment | Tax Consequence Rationale |

|---|---|---|

| General Fitness/Activity | Incentive/Reward System | Taxable as remuneration unless de minimis |

| Targeted Physiological Support | Reimbursement for Documented Medical Expense (Sec. 105) | Non-taxable if directly related to Sec. 213(d) medical care |

| Pre-Tax Contribution Funding | Sec. 125 Cafeteria Plan for Non-Medical Rewards | Reimbursement of pre-tax contributions is generally taxable wages |

The complexity deepens when considering fertility-stimulating protocols for men post-TRT, involving agents like Tamoxifen or Enclomiphene; these are highly specific medical treatments, and structuring their coverage demands an airtight framework to ensure exclusion from the employee’s gross income, which avoids the pitfalls associated with general wellness cash incentives.

We observe a systemic disconnect ∞ the biological system requires precise, personalized intervention to restore vitality, yet the regulatory system often defaults to classifying anything outside of narrow definitions as taxable compensation.

This suggests that the most advanced wellness structures supporting endocrine health must function as bona fide accident and health plans, rather than incentive programs, to secure tax-advantaged status for the employee.

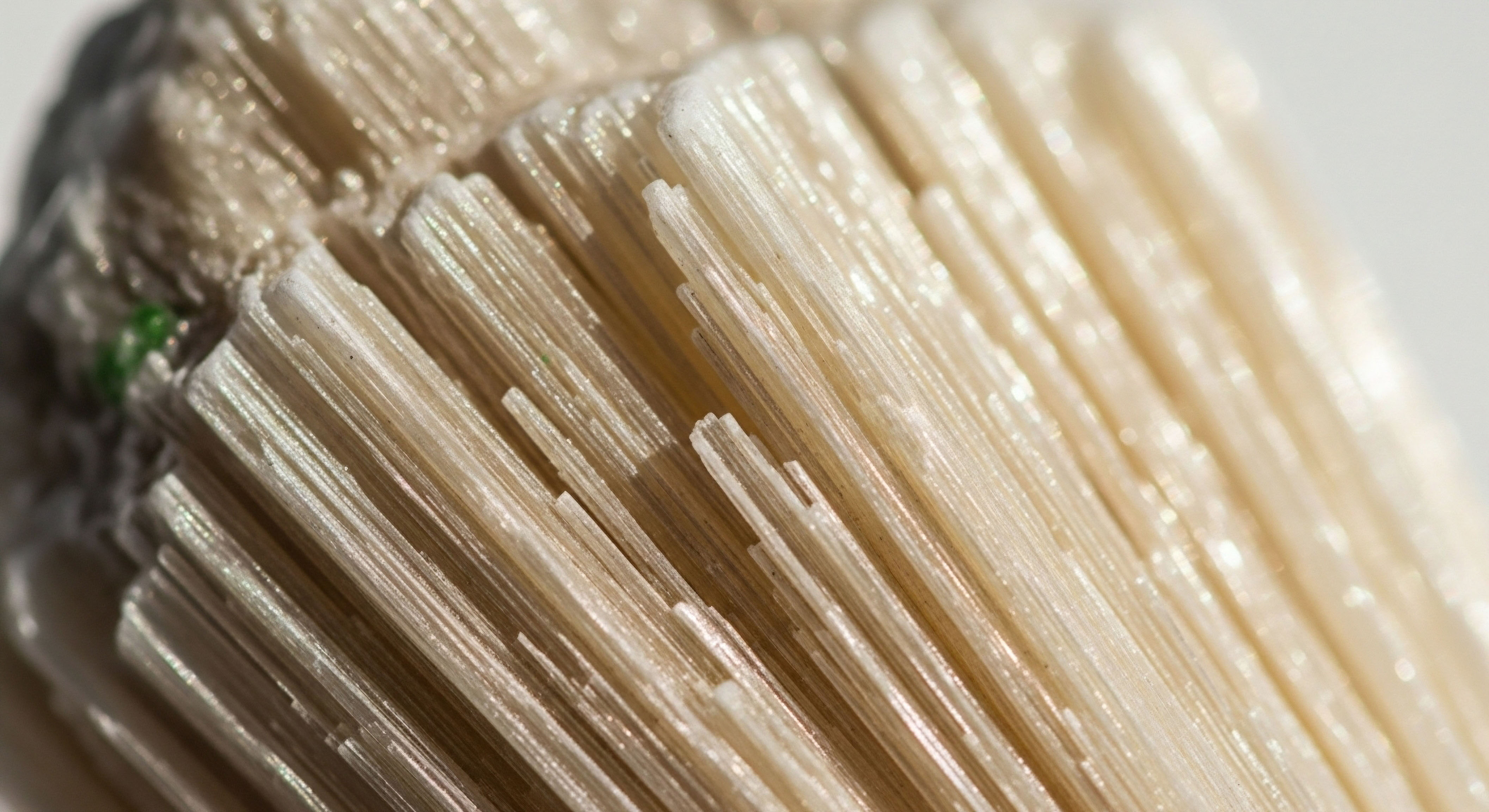

- HPA-HPG Axis Interdependence ∞ Chronic stress elevates cortisol, which functionally suppresses gonadotropin-releasing hormone (GnRH) secretion, thereby dampening the entire HPG axis output, illustrating a systemic failure that requires integrated intervention.

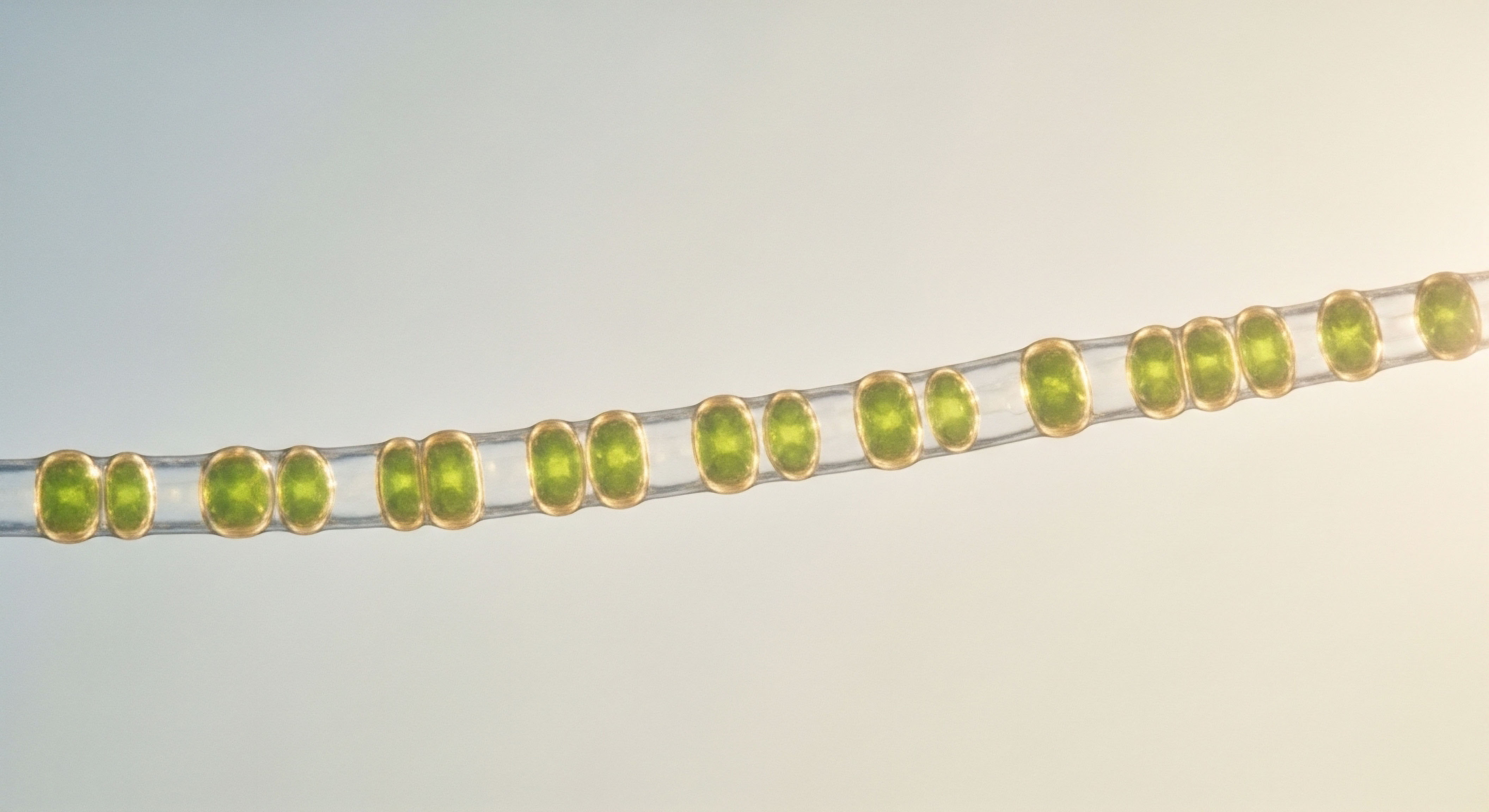

- Peptide Therapy Pharmacodynamics ∞ Growth Hormone secretagogues like CJC-1295 interact with the somatotroph cells to modulate endogenous growth hormone release, a mechanism distinct from exogenous hormone administration, demanding a specific classification for benefit coverage.

- Progesterone’s Receptor Kinetics ∞ In female hormonal balance, Progesterone’s role extends beyond reproductive cycles, acting as a critical neurosteroid influencing GABA receptor function; its prescribed use for mood or sleep disturbances falls squarely under the ‘affecting body function’ clause of medical care.

References

- Cook, M. G. IRS Chief Counsel Advice Memorandum 201622031 ∞ Tax Treatment of Wellness Program Benefits and Employer Reimbursement of Premiums Provided Pre-tax Under a Section 125 Cafeteria Plan. The Tax Adviser, November 2016.

- IRS Chief Counsel Advice Memorandum Number ∞ 202323006. Guidance Denying Favorable Tax Treatment to Certain Wellness Program Incentive Payments. June 2023.

- IRS Regulations Section 1.132-6(c). Definition of De Minimis Fringe Benefit.

- Internal Revenue Code Section 105(b). Amounts Paid Using Accident or Health Insurance.

- Internal Revenue Code Section 213(d). Definition of Medical Care.

- IRS Publication 15-B, Employer’s Tax Guide to Fringe Benefits. Current Revision.

- Gottfried, S. The Hormone Cure ∞ Reclaim Your Energy, Metabolism, Mood, and Sex Drive. Simon & Schuster, 2019. (Used for contextual clinical depth, not direct tax citation).

- Attia, P. Outlive ∞ The Science and Art of Longevity. Avery, 2023. (Used for contextual clinical depth, not direct tax citation).

Reflection

We have charted the intersection where the microscopic world of your cellular biochemistry meets the macroscopic framework of fiscal regulation, recognizing that your body’s need for precise endocrine recalibration is often mirrored by the precision required in administrative coding.

Now, consider this ∞ the knowledge of how your specific biological systems require support ∞ whether through optimizing the HPG axis or managing metabolic signaling ∞ is the true asset you possess.

How will you utilize this understanding of systemic requirements to advocate for or structure wellness benefits that genuinely serve your physiological imperative, rather than settling for structures that only offer a taxable acknowledgment of general good intention?

The pathway toward sustained vitality is built upon the translation of complex science into personal agency; the structures supporting that translation are merely the scaffolding.