Fundamentals

You feel it when your prescription is delayed, that subtle current of anxiety when the medication that helps you feel like yourself is suddenly not there. That experience, that personal moment of uncertainty, is deeply connected to a vast global network of policies, agreements, and economic decisions made thousands of miles away.

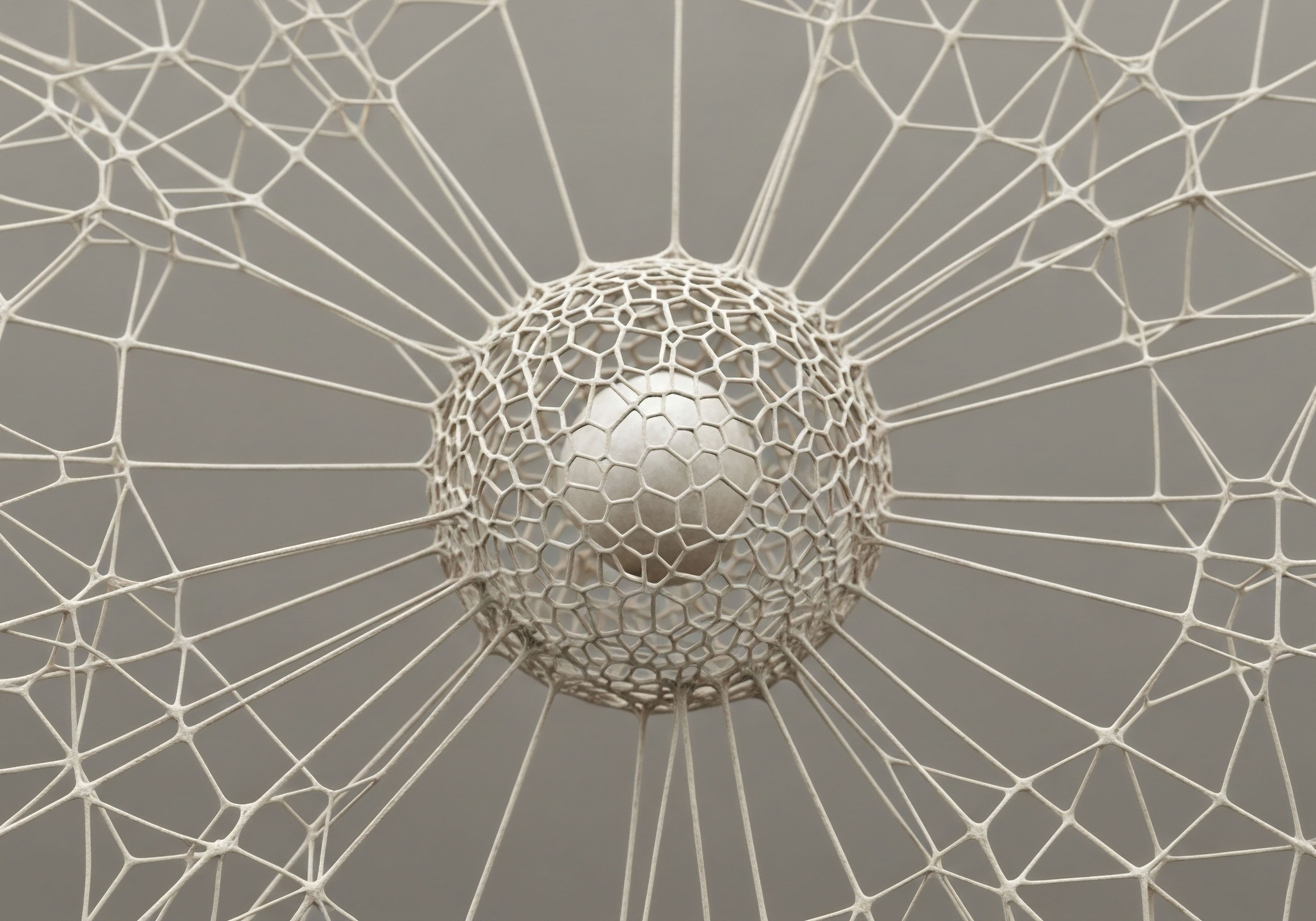

Understanding how global trade policies influence the availability of your essential endocrine medications begins with seeing the journey your medicine takes. It is a complex relay race, passing from raw material suppliers to specialized manufacturers and finally to your local pharmacy, with each handoff governed by international rules.

At the heart of this system is the Active Pharmaceutical Ingredient, or API. This is the core component of your medication, the biologically active substance that interacts with your body’s hormonal pathways. The production of these APIs is highly concentrated, with a significant portion manufactured in a small number of countries, primarily China and India.

This concentration means that economic shifts, political tensions, or new trade rules in one region can create ripple effects that are felt directly in your ability to access consistent treatment. A tariff, which is a tax on imported goods, can increase the cost of these essential ingredients, and those costs are often passed down, influencing the price and availability of the final medication you receive.

These global supply chains are intricate by design, built over decades to optimize cost and efficiency. This has made many medications more affordable and accessible than they might otherwise be. This interconnectedness, however, also introduces vulnerabilities.

When a single country dominates the supply of a key ingredient for a medication like hydrocortisone or testosterone, any disruption ∞ be it a factory shutdown, a natural disaster, or a change in export policy ∞ can lead to shortages across the globe. This reality connects your personal health protocol directly to the world of international commerce, making your wellness journey subject to forces far beyond your control.

Intermediate

The intricate dance of global trade directly choreographs the supply of your endocrine therapies. When we examine the clinical protocols for hormone optimization, whether it’s Testosterone Replacement Therapy (TRT) for men, bioidentical hormone support for women, or adrenal support with hydrocortisone, we find that the key molecules are often sourced and synthesized across multiple continents. Trade agreements and tariffs function like the conductors of this orchestra, capable of creating harmony or discord in the supply chain.

How Do Tariffs Disrupt Hormonal Therapy Protocols?

Imagine the supply chain as a series of interconnected pipelines. A tariff acts as a valve that constricts the flow. When a country imposes a tariff on finished pharmaceutical products or the APIs needed to make them, it raises the cost for the importing country’s manufacturers.

For a man on a standard TRT protocol of Testosterone Cypionate, the raw materials for that testosterone might be synthesized in China, formulated into a final product in India, and then shipped to the United States. A tariff imposed at any stage of this journey increases the final cost. This can lead to higher prices for the patient or, in some cases, cause a pharmaceutical company to deprioritize a less profitable drug, leading to shortages.

A sudden change in trade policy can transform a reliable medication into a scarce resource, impacting patient care directly.

This situation became evident during recent trade disputes, where the threat of tariffs on goods from major API-producing nations sent shudders through the pharmaceutical industry. Companies that rely on single-source suppliers for specific chemicals are particularly vulnerable. They cannot simply switch suppliers, as validating a new source is a lengthy and expensive regulatory process. This creates a precarious situation for patients who depend on a consistent supply of medication for their well-being.

The Role of Manufacturing Concentration

The geographic concentration of API manufacturing creates another layer of complexity. India and China are the dominant forces in API production for many generic drugs, including essential endocrine medications. This reliance creates a significant vulnerability. For instance, India, a major supplier of generic medicines to the U.S.

and Europe, sources a large percentage of its own raw materials from China. Any disruption in China can therefore impact India’s production, which in turn affects the availability of medicines in the West. This interconnected dependency was highlighted during the COVID-19 pandemic when lockdowns in one region led to widespread drug shortages elsewhere.

The table below illustrates how different trade policy factors can influence the availability of common endocrine medications.

| Trade Policy Factor | Impact on Testosterone Therapy | Impact on Insulin Availability | Impact on Hydrocortisone Supply |

|---|---|---|---|

| Tariffs on APIs | Increases the cost of raw materials, potentially raising the price of Testosterone Cypionate injections or pellets. | Raises the manufacturing cost of both human and analog insulins, which may affect patient affordability. | Higher costs for the API can lead to supply constraints for this essential adrenal steroid. |

| Export Restrictions | A producing country could limit exports to secure its domestic supply, causing immediate shortages abroad. | Countries that are major insulin producers could restrict exports during a public health crisis, impacting global diabetes management. | Export bans on the API could create a critical shortage for patients with Addison’s disease. |

| Intellectual Property Rules | Generic versions of testosterone preparations may be delayed from entering the market, keeping prices high. | “Evergreening” patents on insulin delivery systems (like pens) can extend monopolies and delay cheaper biosimilars. | While hydrocortisone is off-patent, complex formulations can still be subject to intellectual property that limits generic competition. |

What Are the Implications of the TRIPS Agreement?

The Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS) is a comprehensive agreement by the World Trade Organization (WTO) that sets minimum standards for intellectual property protection. While intended to foster innovation, these rules can also delay the availability of more affordable generic medications.

Pharmaceutical companies can use patents to maintain exclusive rights to sell a drug for a set period, often 20 years. This affects many endocrine medications, especially newer formulations or delivery systems. For example, while the core molecule of a hormone might be off-patent, the specific injection pen or delivery device can be protected by its own patent, preventing cheaper alternatives from reaching the market.

This practice can keep prices artificially high and limit access for many individuals who rely on these treatments for their metabolic and hormonal health.

Academic

A sophisticated analysis of the pharmaceutical supply chain reveals a system of profound interdependencies, where geopolitical strategies and economic policies directly translate into biological consequences for patients. The availability of essential endocrine medications is contingent upon a fragile global equilibrium, susceptible to disruption from trade protectionism, intellectual property regimes, and the strategic concentration of manufacturing capabilities. Understanding these dynamics requires a systems-level perspective that connects macroeconomic policy to the cellular level of hormonal function.

Geopolitical Vulnerabilities and API Supply Chain Concentration

The modern pharmaceutical supply chain is characterized by a high degree of geographic specialization. The production of Active Pharmaceutical Ingredients (APIs), the foundational components of all drugs, is heavily concentrated in Asia, particularly in China and India. Analysis from the U.S.

Pharmacopeia (USP) shows that India and China together account for a substantial majority of the API Drug Master Files (DMFs) for medications supplied to the United States and Europe. This concentration is a direct result of decades of globalization aimed at reducing costs. It has, however, created significant systemic risks.

A geopolitical disruption, such as a trade war or political instability in a key manufacturing region, can sever critical links in this chain. For example, many Indian pharmaceutical companies, which are major suppliers of generic drugs to the world, depend on China for up to 70% of their raw materials and chemical intermediates.

A trade policy that restricts exports from China can therefore trigger a cascade of production slowdowns in India, ultimately leading to shortages of essential endocrine drugs like metformin, levothyroxine, and even testosterone in Western markets. This dependency creates a strategic vulnerability where public health is hostage to international relations.

The geographic consolidation of API manufacturing represents a critical point of failure in the global pharmaceutical supply system.

The table below details the concentration of API manufacturing and its potential impact on specific endocrine therapy protocols.

| Endocrine Therapy | Primary API Sourcing Regions | Associated Geopolitical Risks | Potential Patient Impact |

|---|---|---|---|

| Testosterone Replacement Therapy (TRT) | China, India | Trade tariffs, export restrictions, quality control issues. | Shortages of injectable testosterone, price volatility, inconsistent access to treatment. |

| Insulin Analogs | Europe, USA, China | Patent disputes, trade bloc protectionism, disruptions in sterile component supply. | High costs due to lack of biosimilar competition, access barriers for advanced insulin formulations. |

| Growth Hormone Peptides (e.g. Sermorelin) | Specialized labs, often in China | Intellectual property theft, regulatory crackdowns, export controls on novel compounds. | Supply interruptions for anti-aging and wellness protocols, lack of long-term supply stability. |

| Adrenal Support (Hydrocortisone) | India, China | Raw material shortages, export limitations during health crises. | Life-threatening shortages for patients with Addison’s disease, forcing reliance on less suitable alternatives. |

The Impact of the TRIPS Agreement on Endocrine Medication Access

The WTO’s TRIPS Agreement establishes a global floor for intellectual property rights, including patent protection for pharmaceuticals. While designed to incentivize research and development, its implementation has had complex effects on medication access.

The 20-year patent life allows originator companies to maintain a market monopoly, setting high prices that can be a significant barrier to care, particularly in low- and middle-income countries but also for underinsured populations in wealthy nations. A systematic review of studies on the topic concluded that stronger intellectual property rules are generally associated with increased drug prices and delayed availability of more affordable generic versions.

This is particularly relevant for endocrine disorders, where treatment is often lifelong. For newer insulin analogs or patented delivery systems for testosterone, the TRIPS framework can prevent the market entry of cheaper biosimilars or generics.

Pharmaceutical companies may also engage in “patent evergreening,” where they make minor modifications to an existing drug or its delivery device to file for new patents, extending their monopoly long after the original patent has expired. These TRIPS-plus provisions, often included in bilateral trade agreements, further restrict the ability of countries to produce or import lower-cost generic versions of essential medicines, directly impacting the long-term health and financial stability of patients with chronic endocrine conditions.

- TRIPS Flexibilities ∞ The agreement includes provisions, such as compulsory licensing, that allow governments to authorize the production of a patented drug without the consent of the patent holder in cases of national emergency or extreme urgency. However, the political and economic pressure exerted by wealthier nations and pharmaceutical lobbies often discourages countries from utilizing these flexibilities.

- Data Exclusivity ∞ A TRIPS-plus provision that prevents drug regulatory authorities from using the clinical trial data of an originator drug to approve a generic version for a certain period. This creates another barrier to market entry for generics, even if the drug is off-patent.

- Impact on Innovation ∞ Proponents argue that strong patent protection is necessary to fund the high cost of drug discovery. Critics, however, point out that it can stifle innovation by discouraging research into areas that are less profitable and that the system prioritizes market exclusivity over public health needs.

References

- “What is the impact of intellectual property rules on access to medicines? A systematic review.” Globalization and Health, vol. 18, no. 1, 2022, pp. 1-18.

- ‘t Hoen, Ellen. “TRIPS, Pharmaceutical Patents, and Access to Essential Medicines ∞ A Long Way From Seattle to Doha.” Chicago Journal of International Law, vol. 3, no. 1, 2002, pp. 27-46.

- Flynn, M. “Global pharmaceutical supply chains ∞ the impact of Trump’s Trade Policies.” The BMJ, vol. 389, 2025, r648.

- “The Risk of Dependency in Pharma Supply Chains.” CHEManager Online, 29 May 2020.

- “Global Barriers to Accessing Off-Patent Endocrine Therapies ∞ A Renaissance of the Orphan Disease?” The Journal of Clinical Endocrinology & Metabolism, vol. 105, no. 10, 2020, pp. 3174-3182.

- “Understanding the Impact of Global Trade on Healthcare Supply Chains ∞ Challenges and Opportunities in Securing Essential Medical Supplies.” Simbo AI, 23 July 2025.

- “Potential measures to facilitate the production of active pharmaceutical ingredients (APIs).” European Parliament, 2022.

- “Global manufacturing capacity for active pharmaceutical ingredients remains concentrated.” U.S. Pharmacopeia Blog, 6 Nov. 2024.

- “Current Risk in the Supply Chain for the Active Pharmaceutical Ingredients Business.” Universal Journal of Pharmacy and Pharmacology, vol. 9, no. 6, 2024.

- “Impact of Globalization on Pharma Supply Chain Dynamics.” Analysis and Metaphysics, 2024.

Reflection

The journey to understanding your body’s intricate hormonal systems is a deeply personal one. The knowledge that your path to wellness is intertwined with global economic currents can feel overwhelming. It places your individual health within a much larger context of international commerce, policy, and manufacturing logistics.

This awareness is a powerful tool. It transforms you from a passive recipient of a prescription into an informed advocate for your own health. The next step in this journey involves considering how this knowledge shapes your conversations with your healthcare provider and your perspective on the resilience of the systems that support your vitality.

Glossary

essential endocrine medications

active pharmaceutical ingredient

hydrocortisone

testosterone cypionate

api manufacturing

generic drugs

drug shortages

intellectual property rights

intellectual property

pharmaceutical supply chain

active pharmaceutical ingredients

trips agreement