Fundamentals

The persistent sensation of a system operating just outside your desired calibration ∞ that subtle but persistent drag on vitality ∞ often stems from regulatory layers you cannot directly observe, let alone influence.

You seek to optimize your biochemical landscape, perhaps through precise hormonal recalibration or metabolic tuning, yet the gateway to that specialized knowledge is often gated by administrative structures established far from the laboratory bench.

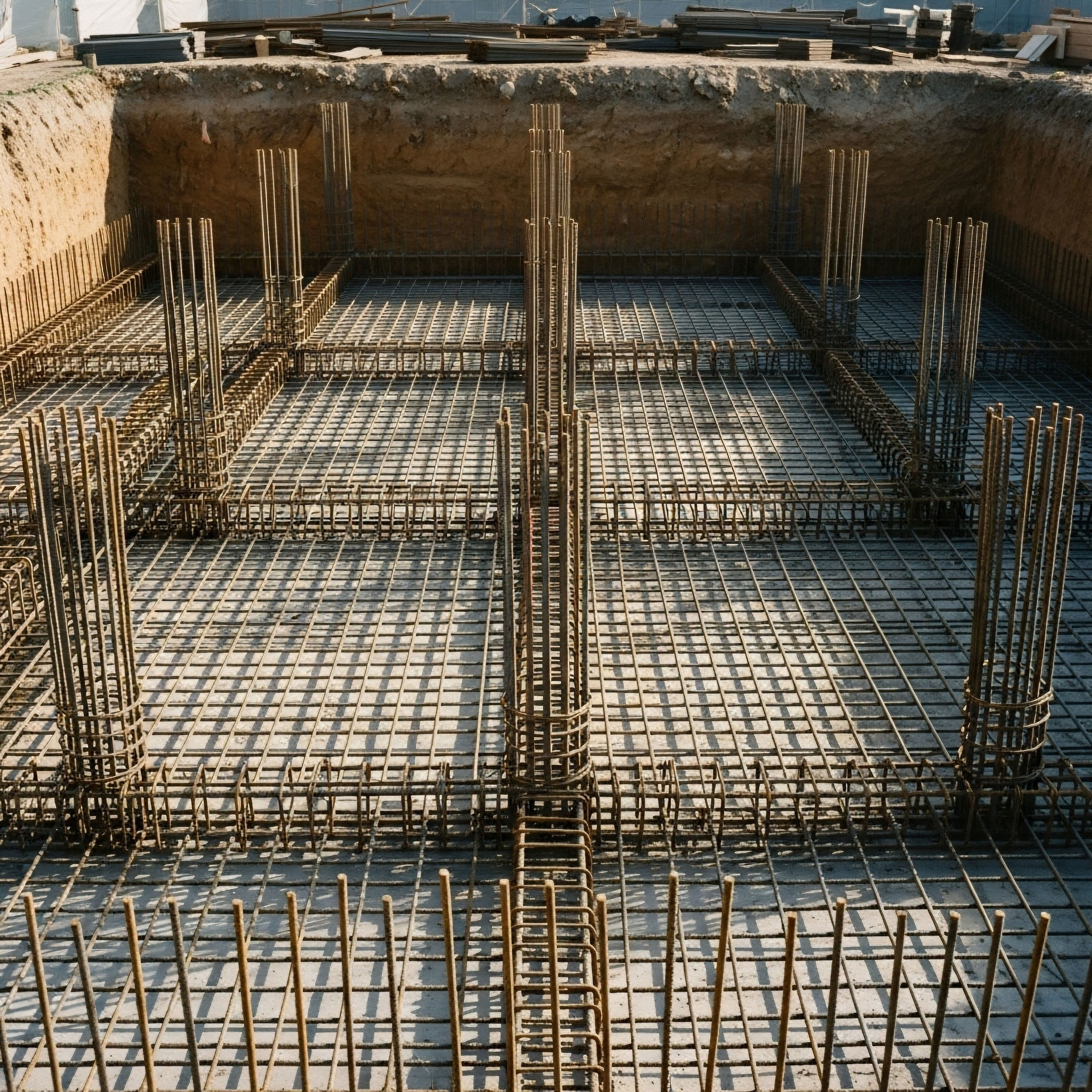

Consider the architecture of your workplace benefits; this is where the initial, often unseen, influence on your access to deep physiological data resides.

The Invisible Regulator of Personal Health Data

When an organization structures its wellness offerings, it is simultaneously engaging with complex federal statutes, most notably the Employee Retirement Income Security Act of 1974, or ERISA.

This legislation dictates the minimum standards for employee welfare benefit plans, effectively drawing a line in the sand regarding what constitutes a regulated health benefit versus a simple educational perk.

This classification is not merely bureaucratic; it fundamentally determines the scope, funding, and incentive structure surrounding any health initiative offered to you as an employee.

The classification of a workplace wellness initiative under federal statute directly dictates the financial and structural support available for your personal biochemical assessment.

When employer contributions are directed toward a program that qualifies as an ERISA welfare benefit plan, the program must adhere to strict standards of non-discrimination and fiduciary responsibility.

Conversely, programs that remain purely informational, avoiding the provision of direct medical care or benefits, occupy a different regulatory space, often exempt from these stringent requirements.

Understanding this delineation reveals why some colleagues receive access to comprehensive biometric panels that inform advanced endocrine support protocols, while others receive only general health pamphlets.

Connecting Structure to Systemic Well-Being

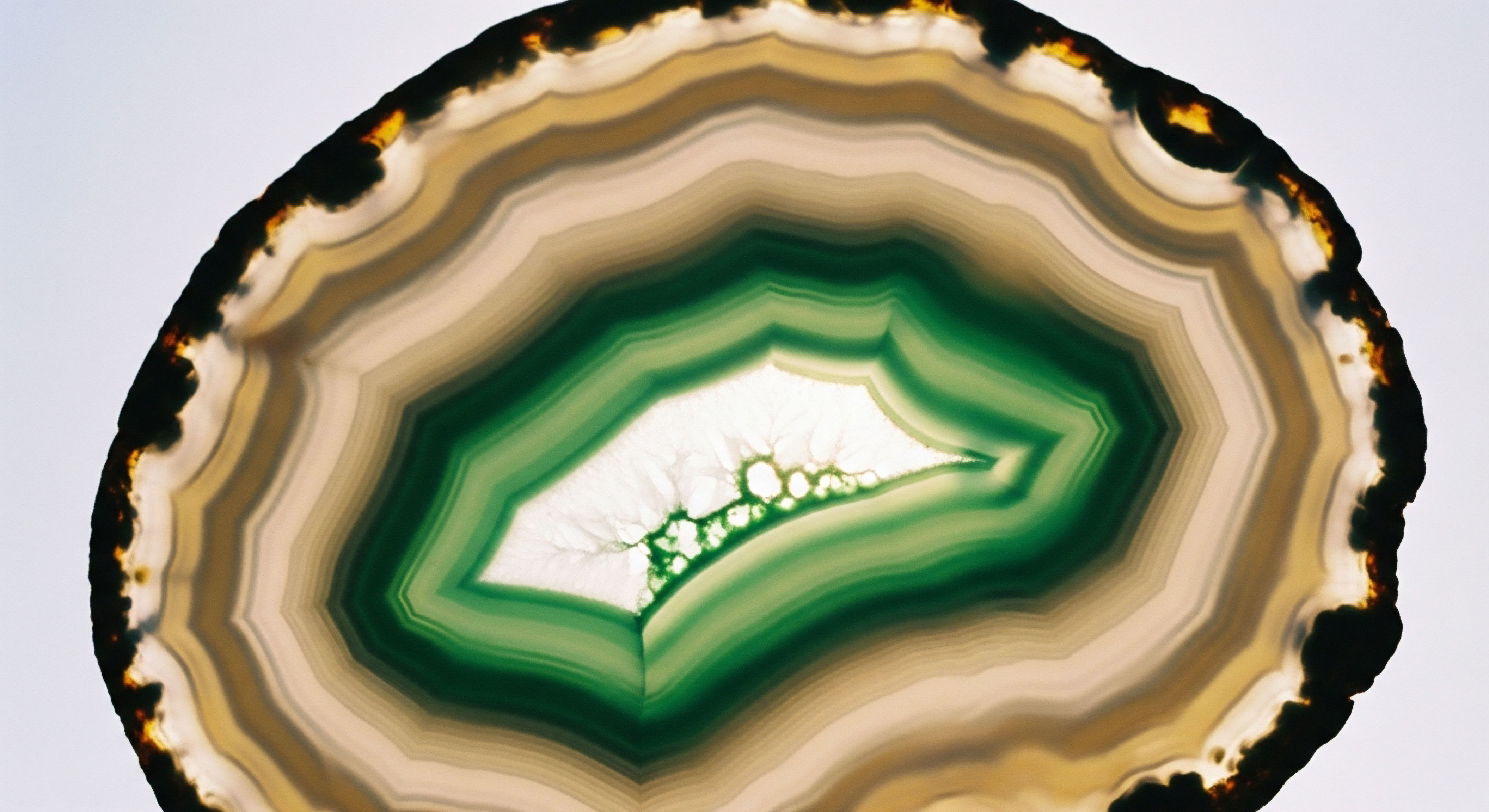

Your endocrine system, that magnificent internal messaging service involving the HPG axis and metabolic signaling, requires precise inputs ∞ accurate data ∞ to function optimally.

If the ERISA structure dictates that the employer-sponsored wellness program only offers basic education, the opportunity for you to secure the advanced diagnostics necessary for, say, tailored testosterone replacement therapy or growth hormone peptide assessment, diminishes significantly.

The financial mechanism ∞ the employer contribution ∞ is the lever that pulls the program across that regulatory threshold, thereby determining its depth of clinical utility for your individual physiology.

We are examining how regulatory compliance becomes a prerequisite for receiving the necessary quantitative feedback to manage your lived experience of fluctuating energy or shifts in body composition.

Intermediate

Moving beyond the initial classification, we must now scrutinize the mechanism by which employer contributions solidify a wellness program’s standing under the ERISA umbrella, a standing that directly impacts the delivery of proactive health monitoring.

When an employer funds a program that includes services deemed to provide “medical care” ∞ such as biometric screenings for lipid panels or advanced body composition analysis ∞ the entire structure defaults to being an ERISA welfare benefit plan.

This default status carries specific obligations for the plan administrator, including the issuance of a Summary Plan Description (SPD) that must clearly delineate participant rights and benefit structures.

The Classification Dichotomy and Diagnostic Access

The presence and structure of employer financial incentives act as a key determinant in this classification.

A wellness incentive structured as a premium reduction or a contribution to a Health Reimbursement Arrangement (HRA) directly impacts the “cost of coverage” calculation under certain incentive limits.

These financial arrangements, supported by employer funds, must be carefully calibrated to remain compliant with ERISA’s non-discrimination rules, which seek to ensure equitable access to rewards based on health factors.

Consequently, the design choices embedded in the financial contribution model shape whether the program can offer the detailed assessments that reveal subclinical endocrine imbalances.

Incentive design, governed by ERISA reward limits, acts as a gatekeeper determining whether wellness offerings provide mere health information or actionable diagnostic feedback.

Consider the divergence in employee experience based on the program’s regulatory identity:

| Program Structure Based on Contribution | ERISA Classification Implication | Impact on Endocrine/Metabolic Data Access |

|---|---|---|

| Employer funds only educational seminars | Typically not subject to ERISA as welfare benefit plan | Limited to generalized guidance; advanced lab testing generally excluded |

| Employer funds biometric screening with feedback | Subject to ERISA as a group health plan (GHP) | Must comply with non-discrimination rules; better potential for integrated, comprehensive lab coverage |

When a program is integrated into the main Group Health Plan (GHP), the regulatory clarity simplifies, allowing for the inclusion of services like advanced hormone testing within established coverage parameters.

However, if the program is stand-alone, the employer must meticulously structure its funding and services to avoid unintended ERISA entanglement while still providing value, a delicate balancing act affecting the depth of personalized care available.

This regulatory scaffolding, built upon employer contributions, creates the operational environment where your ability to secure a full endocrine panel ∞ including free testosterone, SHBG, or detailed insulin sensitivity markers ∞ is either facilitated or obstructed.

Fiduciary Duty and Protocol Alignment

The employer acts as a fiduciary, obligated to administer the plan prudently and in the best interest of participants.

This duty extends to selecting wellness vendors whose protocols align with equitable access, which, in the context of personalized medicine, means ensuring that screening or educational opportunities do not inadvertently exclude individuals needing specific attention for conditions like symptomatic hypogonadism or metabolic syndrome.

The mechanism for this alignment involves careful drafting of the Summary Plan Description, ensuring that the promised benefits, or the structure of the rewards, are transparently communicated to all members of the covered population.

Academic

The convergence of regulatory science (ERISA) and personalized endocrinology demands an examination of how financial structuring dictates the fidelity of diagnostic data available for individual biochemical recalibration.

Specifically, the interplay between employer contributions, the resultant ERISA classification, and the mandate for non-discrimination under 29 CFR § 2520.104b-1 influences the design of risk-based wellness incentives, which are often the conduit for obtaining the laboratory metrics required for advanced hormonal support protocols.

ERISA Non-Discrimination Standards and Health Contingent Rewards

For a wellness program offering health-contingent rewards ∞ such as lower premiums contingent upon achieving a specific A1C or lipid target ∞ the reward cannot exceed 30% of the total cost of coverage, a cost which explicitly incorporates both employer and employee contributions.

This limitation directly constrains the magnitude of financial benefit an employer can offer to drive participation in activities that yield actionable endocrine data, such as detailed lipid fractionation or comprehensive metabolic testing necessary for managing insulin resistance.

Furthermore, ERISA mandates that any such program must offer a Reasonable Alternative Standard (RAS) for any participant for whom satisfying the initial standard is medically inadvisable or unreasonably difficult due to a health factor.

This RAS requirement is the critical interface with personalized wellness, as an employee presenting with severe symptomatic perimenopause or diagnosed hypogonadism requires an alternative path to qualify for the incentive, which is often fulfilled through physician-guided adjustments to their protocol, such as the initiation of low-dose Testosterone Cypionate or Progesterone supplementation, as outlined in established clinical guidelines.

Fiduciary Responsibility in Selecting Diagnostic Vendors

The fiduciary obligation of the plan sponsor necessitates the prudent selection of third-party administrators (TPAs) or wellness vendors.

When a TPA offers a program designed to stratify risk ∞ identifying employees with markers suggestive of low testosterone or pre-diabetic states ∞ the fiduciary must ensure the program design does not violate the prohibition against discrimination based on health status, a central tenet of ERISA.

This means that if the wellness program offers an on-site clinic providing services like physical exams or biometric screenings (thereby classifying it as an ERISA welfare plan), the data gathered must be handled with HIPAA compliance, and the resulting incentives must be universally accessible via the RAS.

The fiduciary mandate requires careful vendor selection to ensure that wellness program incentives, tied to employer contributions, equitably support the early identification of systemic dysregulation across the entire workforce.

The complexity arises when specialized protocols, like those involving Gonadorelin or Enclomiphene to maintain endogenous production during TRT, are not considered standard “medical care” but are preventative for the individual’s long-term function.

The structure of the wellness plan, dictated by its ERISA classification, sets the stage for how easily an employee can transition from a general wellness screening result to the implementation of a targeted, physician-directed endocrine support protocol.

The following table delineates the differential compliance burden and its downstream effect on the data pathway:

| ERISA Program Status | Key Compliance Driver | Effect on Advanced Endocrine Screening Protocol Adoption |

|---|---|---|

| Welfare Benefit Plan (Medical Care Provided) | Non-Discrimination & Disclosure (SPD, Form 5500) | Screening data is integrated; incentive structure is tightly capped (30/50% limit) on total coverage cost. |

| Educational/Discount Program (No Medical Care) | Minimal ERISA requirements; primarily governed by ACA/IRS rules | Screening data is siloed; access to advanced testing relies entirely on standard GHP coverage, outside the wellness incentive structure. |

A self-funded plan, for instance, offers the flexibility to design condition-specific benefits, such as a diabetes management plan with 100% coverage for related visits, which can be leveraged to support metabolic health markers relevant to endocrine function, yet this design must still operate within the overarching ERISA framework to maintain its preemption from certain state regulations.

This regulatory architecture, therefore, is not peripheral to your health autonomy; it is the very foundation upon which the accessibility of your personalized biological data is constructed.

Reflection

Having examined the regulatory scaffolding that underpins workplace wellness, consider the knowledge you now possess regarding the administrative mechanics that govern your access to physiological insight.

The structure of an employer’s financial commitment to your well-being, codified through the lens of federal statute, possesses a tangible influence on the visibility you gain into your own complex biological signaling systems.

As you move forward in optimizing your metabolic function and endocrine vitality, recognize that this initial step ∞ understanding the system that delivers the data ∞ is as vital as interpreting the resulting lab values themselves.

Where does your current path allow for the depth of investigation your system merits, and what questions remain unanswered about the structural limitations placed upon your proactive health management?