Fundamentals

Your question about the regulatory landscape for peptides in China touches upon a critical aspect of our modern health journey. You are seeking to understand how these powerful signaling molecules are managed within one of the world’s most complex economies, and this curiosity is a direct extension of taking ownership of your own biological systems. When you begin to optimize your own health, you naturally start to look at the global context, asking how science, commerce, and law intersect. The answer for China provides a fascinating reflection of our own evolving understanding.

To begin, we must first establish a shared language. In our clinical work, we view peptides as precision instruments for biological communication. These are short chains of amino acids, the body’s own building blocks, that act as highly specific messengers. They instruct cells, tissues, and glands to perform specific functions.

For instance, a peptide like Ipamorelin, which we use to support growth hormone release, is essentially a key designed to fit a very specific lock within the pituitary gland. It tells the body to perform a natural function with renewed vigor. This targeted action is the source of their immense therapeutic potential and the reason they are at the forefront of personalized wellness protocols.

In China, the official frameworks for governing these molecules are highly structured and do not currently contain a dedicated category for “wellness” or “anti-aging” in the way we might discuss it in a Western functional medicine context. Instead, the entire system is built upon a clear, state-supervised binary. A peptide is either a pharmaceutical drug, intended to treat a diagnosed medical condition, or it is an ingredient in a cosmetic product, intended for topical application. There is no officially recognized third path for systemic, wellness-oriented applications.

The Chinese regulatory system for peptides is divided into two distinct pathways a pharmaceutical drug track and a cosmetic ingredient track with no formal category for general wellness.

The Gatekeeper the National Medical Products Administration

The central authority governing this binary is the National Medical Products National growth hormone therapy reimbursement policies vary by strict clinical criteria, quality of life metrics, and health system funding models. Administration, or NMPA. This agency is the sole gatekeeper for any new peptide seeking legal entry into the Chinese market. Its mandate is public health and safety, and it executes this mission through rigorous, evidence-based evaluation. The NMPA’s approach is methodical and deeply rooted in a philosophy of large-scale risk management.

Every decision is made based on extensive data packages, clinical trials, and safety assessments designed to protect a population of over a billion people. This perspective shapes the entire commercial and legal environment for peptides in the country.

Understanding the NMPA’s role is the first step to grasping the Chinese framework. For a peptide to be sold legally, it must have passed through one of the NMPA’s two main gates. The requirements for each gate are entirely different, and this distinction dictates how a peptide can be researched, manufactured, marketed, and ultimately used by an individual.

The Pharmaceutical Gateway

If a company wishes to market a peptide for a therapeutic purpose, such as managing diabetes or promoting weight loss, it must undergo the full drug approval process. This is a long and resource-intensive path involving preclinical studies, multi-phase human clinical trials, and an exhaustive review by the NMPA’s Center for Drug Evaluation Meaning ∞ The Center for Drug Evaluation is a pivotal regulatory body responsible for the thorough assessment and approval of pharmaceutical products intended for human use. (CDE). The goal here is to prove both safety and efficacy for treating a specific, recognized disease.

Peptides in this category are prescribed by physicians and dispensed through pharmacies. They are part of the formal medical system, intended to correct a pathological state.

The Cosmetic Gateway

Alternatively, if a peptide is intended for topical use in a skincare or beauty product, it must be approved as a cosmetic ingredient. The regulation here is governed by the Cosmetics Supervision and Administration Regulation (CSAR). If a peptide is not already on the Inventory of Existing Cosmetic Ingredients in China (IECIC), it must go through a New Cosmetic Ingredient Meaning ∞ A New Cosmetic Ingredient refers to a chemical entity or biological extract not previously utilized in cosmetic formulations within a specific regulatory jurisdiction. (NCI) notification process.

The focus here is on safety for topical application, and the claims that can be made are limited to cosmetic benefits like skin protection or hydration. These peptides are designed to work on the skin’s surface and are not evaluated for systemic effects on the body’s internal endocrine systems.

This foundational understanding of the NMPA’s dual-track system is the lens through which we must view your question. The commercial and legal frameworks in China are direct consequences of this regulatory structure. The opportunities for businesses and the options available to individuals are all shaped by whether a peptide is classified as a medicine or a cosmetic ingredient.

Intermediate

Having established the foundational binary of pharmaceutical versus cosmetic regulation in China, we can now examine the specific mechanics of each pathway. For you, as someone deeply invested in the science of personal optimization, understanding these processes reveals the underlying philosophy that governs how peptides are integrated into Chinese society. It is a system built on methodical validation and risk stratification, which presents a clear contrast to the more flexible, practitioner-guided wellness models seen elsewhere.

What Is the Path for a New Peptide Drug in China?

The journey for a therapeutic peptide in China is a testament to clinical rigor. The NMPA’s drug approval process Meaning ∞ This structured pathway ensures new medicinal compounds meet rigorous standards for patient well-being and therapeutic benefit before widespread use. is a multi-year endeavor designed to leave no stone unturned regarding safety and efficacy. This pathway is reserved for molecules that make a clear medical claim, such as treating type 2 diabetes or obesity.

A prominent example is the class of GLP-1 receptor agonists, peptides that have become central to metabolic health Meaning ∞ Metabolic Health signifies the optimal functioning of physiological processes responsible for energy production, utilization, and storage within the body. discussions worldwide. In China, their rise is not a “wellness” trend; it is a calculated pharmaceutical strategy to combat a public health challenge.

The process unfolds in sequential phases, each with a distinct purpose:

- Preclinical Research Before any human testing, the peptide must be extensively studied in laboratory and animal models. This phase establishes its basic pharmacological profile, mechanism of action, and, most importantly, its safety and toxicological limits. These studies must adhere to Good Laboratory Practice (GLP) guidelines.

- Investigational New Drug (IND) Application The manufacturer compiles the preclinical data into a comprehensive package and submits it to the NMPA’s Center for Drug Evaluation (CDE). If the CDE is satisfied, it grants permission to begin human clinical trials.

- Clinical Trials This is the most critical and lengthy stage, typically broken into three phases, mirroring international standards.

- Phase I A small group of healthy volunteers receives the peptide to assess its safety, determine a safe dosage range, and identify side effects.

- Phase II The peptide is given to a larger group of people who have the target medical condition. This phase gathers preliminary data on efficacy and further evaluates safety.

- Phase III The trial expands to a large, diverse patient population to confirm efficacy, monitor side effects, compare it to commonly used treatments, and collect information that will allow the peptide to be used safely.

- New Drug Application (NDA) and Review Following successful clinical trials, the company submits an NDA containing all manufacturing, preclinical, and clinical data. The CDE conducts a thorough review, which can take one to two years. If the review is positive, the NMPA grants marketing authorization.

- Post-Market Surveillance After approval, the manufacturer must continue to monitor the drug for adverse events and submit periodic safety reports to the NMPA.

This structured, evidence-driven process ensures that any peptide marketed as a medicine has been thoroughly vetted. From a commercial standpoint, it represents a massive investment, but one that unlocks access to China’s vast healthcare market. From your perspective, it means that if a peptide is available as a prescription in China, it has a deep well of clinical data supporting its use for a specific condition.

The pharmaceutical approval pathway in China is a rigorous, multi-year process of clinical trials designed to validate a peptide’s safety and efficacy for treating a specific disease.

How Does the NMPA Classify Cosmetic Peptides?

The framework for cosmetic peptides operates on a different set of principles. Here, the primary concern is the safety of topical application. The Cosmetics Supervision and Administration Regulation (CSAR) is the guiding law.

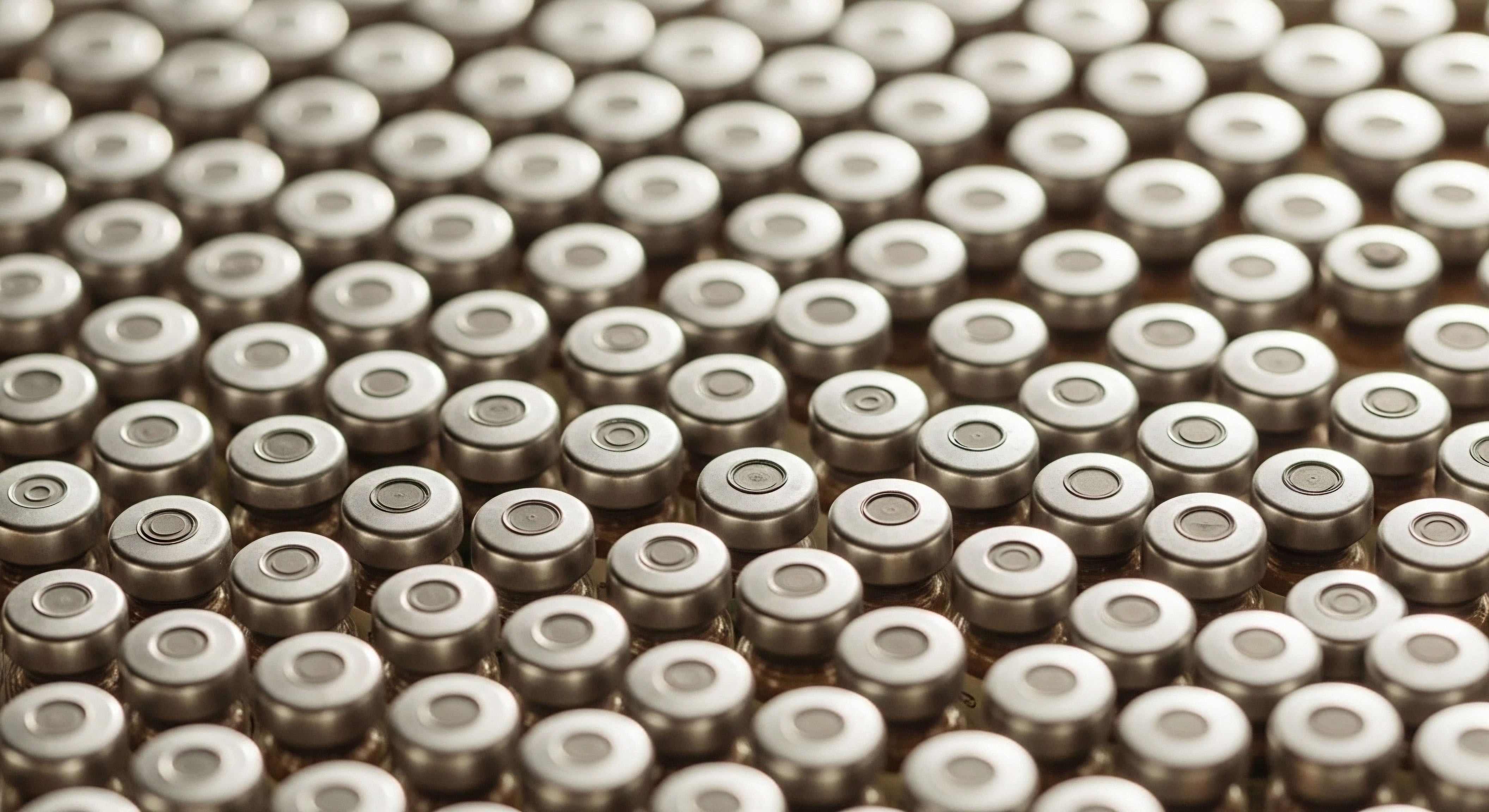

The system hinges on the Inventory of Existing Cosmetic Ingredients in China (IECIC). As of late 2024, this list contained only 79 peptide ingredients, a small fraction of the number used in Europe or the United States, signaling a cautious and controlled approach.

For a company to use a peptide not on this list, it must navigate the New Cosmetic Ingredient (NCI) notification process. This involves submitting a dossier to the NMPA Meaning ∞ NMPA, or Neuro-Modulatory Peptide Agonist, refers to a class of biological agents designed to activate specific peptide receptors located within the nervous system. with detailed information on the ingredient’s manufacturing process, stability, and a comprehensive safety assessment. This assessment includes toxicological data to prove it is safe for use on the skin. Since 2021, there has been a steady stream of NCI notifications for peptides, with Chinese companies leading the charge.

The table below outlines the fundamental differences in how a peptide is treated in each framework.

| Aspect | Pharmaceutical Framework | Cosmetic Framework |

|---|---|---|

| Governing Body | NMPA – Center for Drug Evaluation (CDE) | NMPA – Department of Cosmetics Regulation |

| Primary Regulation | Drug Administration Law | Cosmetics Supervision and Administration Regulation (CSAR) |

| Primary Goal | Prove safety and efficacy for treating disease | Prove safety for topical application |

| Allowed Claims | Specific medical claims (e.g. “lowers blood glucose”) | Cosmetic function claims (e.g. “skin conditioning,” “moisturizing”) |

| Route of Administration | Systemic (e.g. injection, oral) | Topical (e.g. cream, serum) |

| Evidence Required | Extensive multi-phase clinical trials in humans | Toxicological testing, safety assessment, stability data |

| Market Access | Prescription from a physician, dispensed at a pharmacy | Over-the-counter retail, e-commerce |

This dual-framework system creates a very specific commercial landscape. The market for therapeutic peptides is a high-stakes pharmaceutical race, with dozens of companies conducting clinical trials Meaning ∞ Clinical trials are systematic investigations involving human volunteers to evaluate new treatments, interventions, or diagnostic methods. for blockbuster drugs like GLP-1 agonists. The market for cosmetic peptides is a fast-moving consumer goods space, where companies compete by formulating products with novel, NCI-notified peptides to appeal to a growing demand for advanced skincare. What is absent is a regulated space for the peptides you may be familiar with from personalized wellness protocols—molecules like Sermorelin, BPC-157, or Tesamorelin—which are used systemically for benefits related to tissue repair, metabolic optimization, or enhancing endocrine function.

Academic

Our exploration now moves to a deeper analysis of the Chinese regulatory philosophy and its global implications. From a systems-biology perspective, peptides are the body’s endogenous language of adaptation and repair. The way a nation chooses to regulate them reflects its core priorities regarding public health, economic development, and medical innovation.

The Chinese model, with its stringent pharmaceutical and cosmetic gates, is a direct product of a state-guided industrial policy aimed at fostering domestic champions in high-tech sectors while maintaining tight control over public safety. This approach creates a fascinating divergence from the wellness-oriented peptide landscape that has emerged in North America and Europe.

Does a Wellness Category for Peptides Exist in China?

The direct answer is no. The concept of using potent, systemically-acting peptides for purposes categorized as “wellness,” “longevity,” or “optimization” in healthy individuals does not have a formal regulatory pathway in China. This absence is a defining feature of the framework. Peptides used in our clinical protocols, such as Growth Hormone Releasing Hormones (GHRHs) like Sermorelin or Growth Hormone Releasing Peptides (GHRPs) like Ipamorelin, would be unclassifiable within the current NMPA system if marketed for wellness.

They are not cosmetics, as they are administered systemically via subcutaneous injection. They are also not approvable as drugs, because they are not intended to treat a specific, recognized disease in the conventional sense. Instead, they are used to optimize the function of the hypothalamic-pituitary-gonadal (HPG) axis and restore youthful signaling patterns.

This regulatory gap has profound consequences. It means that the entire ecosystem of compounding pharmacies, functional medicine clinics, and anti-aging specialists that facilitates access to these therapies in the West does not have a legal equivalent in China. The commercial activity is therefore bifurcated into two extremes ∞ the highly regulated, multi-billion dollar pharmaceutical market for disease treatment, and a burgeoning, officially sanctioned cosmetics market. The market for GLP-1 agonists, for instance, is projected to be enormous, with over 60 domestic drug candidates in late-stage trials to compete with established international products.

This is where capital and research are being deployed. Simultaneously, Chinese cosmetic companies are rapidly innovating, filing NCI notifications for new topical peptides to gain a competitive edge in the massive skincare market.

The absence of a regulatory category for “wellness” peptides in China channels all commercial and research activities into the strictly defined pharmaceutical and cosmetic sectors.

Innovation Models a Comparative Analysis

The Chinese framework fosters a specific type of top-down innovation, while the more liberal Western model allows for bottom-up discovery and application. A comparison of these two models reveals the trade-offs between centralized control and decentralized exploration. The following table provides a detailed analysis of these divergent ecosystems.

| Feature | Chinese Regulatory Model | Western Wellness Model |

|---|---|---|

| Primary Driver | State-identified public health needs and economic goals (e.g. combating diabetes, building a domestic biotech industry). | Patient-driven demand for optimization, longevity, and proactive health management, facilitated by clinicians. |

| Innovation Focus | Developing novel drug candidates for major diseases (e.g. GLP-1s) and new topical ingredients for cosmetics. High-investment, long-timeline projects. | Exploring novel applications for existing peptides and developing new signaling molecules for wellness and repair (e.g. BPC-157, Tesofensine). |

| Key Players | Large pharmaceutical corporations, government-backed research institutes, major cosmetic brands. | Compounding pharmacies, independent research labs, academic institutions, functional medicine clinics, biotech startups. |

| Regulatory Pathway | Formal NMPA drug approval or NCI cosmetic notification. Clear, rigid, and lengthy. | A mix of FDA drug approval, off-label prescribing, and use of substances designated for research purposes, creating more flexibility. |

| Access Mechanism | Physician prescription for approved drugs; over-the-counter for cosmetics. | Consultation with a specialist physician who may prescribe compounded peptides tailored to the individual’s biochemistry. |

| Commercial Result | Concentrated market with high barriers to entry, dominated by a few major players in each category. | A more fragmented and diverse market with numerous smaller players catering to specific niches within the wellness community. |

The Unregulated Third Space and Future Trajectories

The lack of a formal framework for wellness peptides Meaning ∞ Wellness Peptides are short chains of amino acids, naturally occurring or synthetically derived, functioning as signaling molecules within the human body. does not eliminate demand. It simply pushes it into an unregulated “grey market.” Individuals in China seeking peptides like Tesamorelin or Melanotan II for their systemic effects must turn to channels that operate outside of official oversight. Online vendors and international sourcing become the primary means of access, which introduces significant risks regarding product quality, purity, and safety.

There is evidence of a thriving online marketplace for these substances, often sold with minimal guidance and no medical supervision. This situation presents a challenge for Chinese regulators, as suppressing this demand is difficult, yet creating a legal framework for it would require a fundamental shift in regulatory philosophy.

Looking forward, several factors could influence the evolution of China’s peptide frameworks. The immense success and profitability of the domestic pharmaceutical and cosmetic peptide industries are building a formidable base of expertise in peptide research, development, and manufacturing. As Chinese consumers become more affluent and health-conscious, the demand for proactive wellness and longevity solutions is likely to grow. This could create internal pressure to establish a regulatory pathway for products that fall into the current gap.

Furthermore, the expiration of key patents, such as the one for semaglutide in 2026 in China, will unleash a wave of generic competition, potentially driving down prices and making these powerful metabolic tools more accessible. This could normalize the use of peptides for managing metabolic health, blurring the line between disease treatment and optimization. It is conceivable that China may eventually develop a third category for “functional foods” or “health products” that could encompass certain peptides, similar to frameworks in Japan or South Korea. For now, however, the legal and commercial landscape remains firmly divided, a reflection of a system that prioritizes centralized control and validated, disease-centric applications over the personalized, practitioner-guided world of wellness protocols.

References

- Pacific Bridge Medical. “Navigate China’s Drug Approval Process.” Pacific Bridge Medical, 1 May 2023.

- ZMUni Compliance Centre. “Unlocking Opportunities in China’s Booming Peptide Market ∞ Key Insights and Compliance Pathways.” ZMUni, 11 Oct. 2024.

- Freyr Solutions. “13 FAQs ∞ Unlocking the Drug Approval Process in China.” Freyr, 11 Oct. 2023.

- ZMUni Compliance Centre. “China’s NCI Approval Updates ∞ Peptides Continue to Gain Attention.” ZMUni, 22 July 2025.

- He, Eric. “Explainer | Svelteness in China is a US$150 billion market, with dozens of drug producers vying for it.” South China Morning Post, 10 July 2025.

- National Medical Products Administration. “Provisions for Drug Registration.” NMPA, 30 June 2022.

- REACH24H. “Updates on Cosmetic Regulations in China | June 2022.” REACH24H, 6 July 2022.

- Biorius. “China Cosmetic Regulations – Comprehensive Guide.” Biorius, 2023.

Reflection

Your Personal Health Blueprint

We have journeyed through the intricate legal and commercial structures that govern peptides in China, seeing how a nation’s philosophy shapes its approach to science and health. This exploration of another system serves a deeper purpose. It acts as a mirror, prompting you to consider the foundations of your own health philosophy.

You began this process by listening to your body’s signals and seeking to understand the underlying biological conversations. The knowledge of how different systems operate, whether it’s your own endocrine system or a national regulatory body, adds a new layer of context to your journey.

The path to reclaiming your vitality is yours alone to walk. The information presented here is a map of one part of the world, designed to enrich your perspective. Your personal biological blueprint, however, is unique.

The next step is always about integrating this broader knowledge with the specific, intimate data of your own life—your symptoms, your lab results, and your goals. This synthesis is where true empowerment lies, turning information into a personalized protocol for a resilient and functional life.